In The Spotlight

"The first thing that is important for the overall management of the company is to start trying to be visible," said the group chief executive officer of Nigerian National Petroleum Company, Bashir Bayo Ojulari, at the International Energy Week, while speaking to Andy Brown, the president of Energy Institute, which recently hosted the event's seventh edition in London

As the NNPC works towards achieving 3 million barrels of oil per day by 2030, the government-turned-private company is reviewing its portfolio as it undergoes major revisioning and restructuring. Ojulari hailed this as a very bold step on the Nigerian President's part, especially because the injection of international oil company veterans complemented the company's regional structure to form a new leadership team.

"Based on what we have seen so far, we are firstly restructuring the shape of our partnerships. Majority of our production, as you know, is in partnership with Shell, ExxonMobil, and other private companies. We focused on aligning our programmes and plans with these partners so that we have a joint committee," he said, alongside highlighting financing as a second challenge, which is also driving the company's portfolio decisions.

NNPC's vision lies in pushing industrialisation within Nigeria and the rest of sub-Saharan Africa, while expanding the localisation of both oil and gas. The company's focus on meeting energy demand within Africa stands clear even at international platforms such as the Organisation of the Petroleum Exporting Countries, where its strategy is more about deepening utilisation of its own resources than just producing and exporting. To ramp up expansion on the downstream side, the major Dangote refinery besides, several local refineries are currently operational as well. NNPC has thus identified significant downstream projects that can potentially support additional power generation, industrial gas-based industries, fertilisers and petrochemical points. Last year alone five agreements have been signed to advance utilisation across the region.

Gas is also a major element for NNPC in catapulting industrialisation in Africa. For starters, industrial parks in Nigeria were identified as supply points for mass consumption. These will be brought under the mega-infrasrtucture of the highly anticipated Ajaokuta–Kaduna–Kano Natural Gas Pipeline and the Obiafu-Obrikom-Oben pipeline projects that are ready for commissioning this year. The combined capacity of these two pipelines are set to exceed 2 billion cubic feet of gas per day.

"We're passionate about connecting Africa," said Ojulari as he mentioned the African Atlantic Gas Pipeline that is set to run across West Africa down to Morocco. Expressing excitement regarding the project's viability inspite of its challenges, he said, "But today it's commercially very profitable venture...our plan is to just go in chunks. So the next is to go to Ivory Coast." Assuring that a list of countries are lined up to join the project, he explained, "Some of those countries also have gas resources, but they do not have the economy or scale. So the idea of that pipeline is that those countries that have stranded gas can also connect their gas to the pipeline as well as take the gas."

Having served six years as the managing director of Shell Nigeria Exploration and Production Company, Ojulari's new role demands fresh approach towards success. "In Shell and in other IOC companies...we focus on the financial side of the opportunity...And then when we are all done, let's look at the non technical," he said while explaining how IOCs have their own framework with technical, economic, commercial, organisational and political aspects. And once all that are figured out, they check the competition in the industry.

On the other hand, speaking of his new role, he said, "We can't afford to do that in my world. We start with the political...It becomes more critical because here NNPC is owned by the 230 million Nigerians. They are shareholders. They have appointed two entities -- the finance ministry and the petroleum industry to be the holders of the shares. So our accountability is to these 230 million people. We cannot afford to exclude ourselves from the political structure. We are carrying people along...bringing in the key people."

He went on to add, "We are starting a project. You need to bring somebody from the Minister of Finance. We bring them up. So that way we all get to be part of the project. We're making progress...we are more confident, and we are getting a lot of support in terms of the direction we're going."

According to Ojulari, establishing capital and organisational discipline is critical in achieving operational excellence and NNPC's future repositioning. He acknowledged the role of the company's leadership in bringing on board the sheer knowledge around how exploration and production businesses should be run, and how that knowledge is being transmitted to the country's gas power, new energy and downstream business. This also allows the company to be prepared to demonstrate "what it looks like" as when political influence comes into question, a lot depends "around the ability to show what it looks like".

While the fundamental structures around the paperwork are in place for NNPC's transition into a private company post the Petroleum Industry Act 2021, changing the deep-rooted culture still remains one of the biggest challenges. "From being a corporation to a privately owned company, what we have realised is that the Nigerians are not fully clear of the [transition]. It requires a lot of interaction."

The community-based surveillance structure that has been introduced by the government to address oil theft issues in Nigeria has proved a success on this matter. Involving the combined efforts of not just the security forces but also the community, a 100% availability was achieved in production reconciliation in the terminals, which earlier went as low as 10%.

"Most times we look at [such] challenges from a security perspective, but is a fundamental social problem. Here you have an environment where you still need a lot of development and a lot of social structure. So what was unique about this surveillance structure was that it was a community based surveillance structure which then combined the effort of the community as well as the effort of the security forces. And what we started to see is that once we integrated and focused on development of the communities as well, we started achieving 100% availability...for the last nine months now," said Ojulari.

The Nigerian National Petroleum Company has identified the key pillars for securing Africa’s energy future during the recently concluded 2026 International Energy Week (IEW) in London

The NNPC's group chief executive officer, Bashir Bayo Ojulari, highlighted the importance of shared infrastructure, policy alignment, coordinated investment frameworks, cross-border knowledge and technology exchange, integrated gas market development, and sustained regional diplomacy among national oil companies (NOCs).

As shared assets can lead to scale, efficiency and resilience, NNPC is prioritising the expansion of cross-border energy infrastructure, with regional gas initiatives ongoing in the region. Flagship projects such as the Nigeria–Morocco Gas Pipeline and the West African Gas Pipeline are critical for advancing regional integration and cross-border energy trade.

Ojulari said that the continent must move towards aligned pricing frameworks, transit protocols, local content standards, and joint technical regulations, drawing lessons from reforms such as Nigeria’s Petroleum Industry Act (PIA), to reduce investment friction, safeguard cross-border infrastructure, and ensure equitable access to shared energy assets.

“Our pathway is clear: grow production responsibly, scale gas as the backbone of Africa’s industrialisation, strengthen environmental accountability, and align with global decarbonisation objectives—while ensuring that Africans are not left behind in the energy transition,” he said.

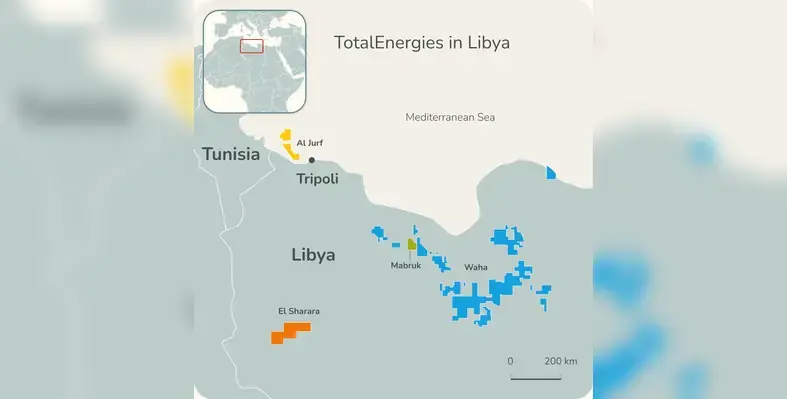

The 2025 Libyan Bid Round has won American major, Chevron, onshore Contract Area 106 located in the Sirte Basin

The country's National Oil Corporation has signed a memorandum of understanding (MoU) with the major's subsidiary, Chevron Business Development EMEA Ltd, in Tripoli to evaluate the development and exploration potential in the region.

“Chevron is excited to enter Libya with the award of onshore Contract Area 106, which underscores our focus on North Africa and the Eastern Mediterranean region, and is a good fit in our exploration strategy to grow our portfolio with high-quality acreage and high impact prospects,” said Kevin McLachlan, vice president of exploration at Chevron.

“Libya has significant proven oil reserves and a long history of producing its resources. Chevron is confident that its proven track record in developing oil and gas projects and its technical expertise gives it the ability to support Libya to further develop its resources.”

The award of the Contract Area is subject to the execution of a Production Sharing Agreement.

“Chevron looks forward to our partnership with NOC and other key stakeholders in Libya. The Contract Area award and MoU are important milestones as we continue to evaluate opportunities to support Libya’s energy sector,” said Frank Mount, President of Corporate Business Development.

Chevron has a diverse exploration and production portfolio in the Mediterranean and Africa and continues to assess potential future opportunities in the region. Chevron is one of the largest producers and acreage holders in Nigeria, Angola and Equatorial Guinea. It has two exploration blocks each in Namibia and Guinea-Bissau, and three exploration blocks in Egypt.

The Nigerian National Petroleum Company has identified the key pillars for securing Africa’s energy future during the recently concluded 2026 International Energy Week (IEW) in London

The NNPC's group chief executive officer, Bashir Bayo Ojulari, highlighted the importance of shared infrastructure, policy alignment, coordinated investment frameworks, cross-border knowledge and technology exchange, integrated gas market development, and sustained regional diplomacy among national oil companies (NOCs).

As shared assets can lead to scale, efficiency and resilience, NNPC is prioritising the expansion of cross-border energy infrastructure, with regional gas initiatives ongoing in the region. Flagship projects such as the Nigeria–Morocco Gas Pipeline and the West African Gas Pipeline are critical for advancing regional integration and cross-border energy trade.

Ojulari said that the continent must move towards aligned pricing frameworks, transit protocols, local content standards, and joint technical regulations, drawing lessons from reforms such as Nigeria’s Petroleum Industry Act (PIA), to reduce investment friction, safeguard cross-border infrastructure, and ensure equitable access to shared energy assets.

“Our pathway is clear: grow production responsibly, scale gas as the backbone of Africa’s industrialisation, strengthen environmental accountability, and align with global decarbonisation objectives—while ensuring that Africans are not left behind in the energy transition,” he said.

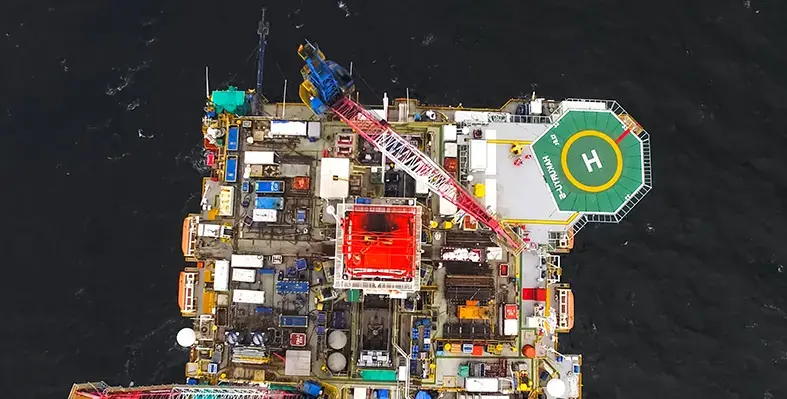

Shearwater Geoservices has partnered with Harvex Geosolutions and the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) to begin fresh multi-client seismic project offshore Nigeria

Supported by strong industry funding, the 3D survey is set to start in December 2025. Shearwater is gearing up to deploy its high-end vessel SW Duchess for the project, whereby it will be operational over a period of two months. It will heavily support survey work for extracting high-resolution subsurface data across the Western Niger Delta Basin which, in turn, will influence significant exploration decisions and future license rounds in one of West Africa’s most prospective oil and gas regions.

“This project underscores the growing momentum of our multi-client business and our key role in supporting exploration across key global basins,” said Irene Waage Basili, CEO of Shearwater. “By investing in high-quality seismic data, where we can both capture rapid returns and create longer-term value, we are enabling smarter decisions and helping to shape the future of energy security in West Africa and beyond.”

Previously, Shearwater also announced service contract offshore Ghana, carrying out the region's first deepwater Ocean Bottom Node (OBN) seismic survey in the Jubilee and TEN fields. This contract was a result of the company's already well-established presence in West African regions, including the deployment of the SW Tasman vessel and Pearl node OBN platform. Since late 2024, these platforms have been instrumental in conducting OBN surveys across the region, starting with Côte d'Ivoire, and continuing with surveys in Angola.

The AK-2H well in the Seme Field in Block 1, Benin, inches towards production as Akrake Petroleum Benin SA concluded drilling operations in the area

The company is now working on completion activities to make the well production-ready by early February. It has been designed to drain the western section of the Seme Field from the H6 reservoir.

The well will be screened covering the reservoir sandstone formation, and a down-hole electrical submersible pump (ESP) will be installed.

Alongside, installation of the mobile offshore production unit (MOPU), Stella Energy 1, and the floating storage & offloading unit (FSO), Kristina, are in the final stages.

The MOPU installation activities which involved flowlines connection set-ups and other technical addressing were responsible for some delays in production start-up.

Akrake Petroleum's Seme Field redevelopment campaign involves a 100-day three-well work-programme. It includes the drilling of two horizontal production wells in the H6 formation (previously developed), as well as a deeper vertical appraisal well to gather data from the H7 and H8 reservoirs, to facilitate the potential advancement to Phase 2 of the development.

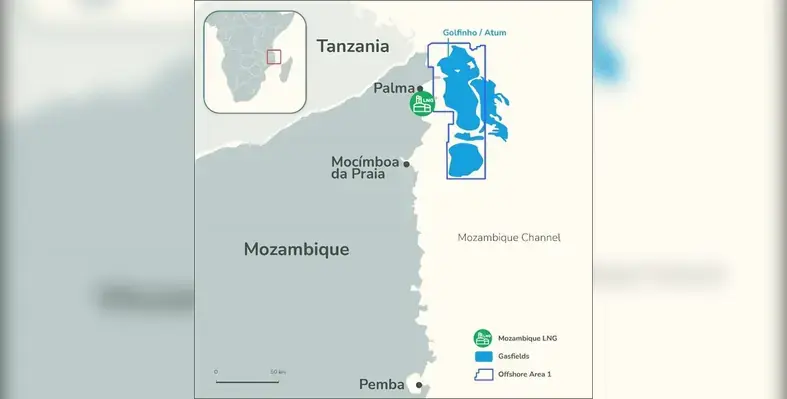

The Coral North Floating Liquefied Natural Gas Project, which is a mega infrastructure being developed by Eni, and can be transformative for Mozambique's energy sector, will be backed by a US$150mn senior loan from the Board of Directors of the African Development Bank

The development work, including construction and operation of a 3.55mn metric tonnes-strong LNG facility, follows that of the successful Coral South FLNG project, which has been operational since 2022.

Facilitated with the support of other development finance institutions, export credit agencies and commercial lenders, this investment by the AfDB can help the Coral North generate US$20bn worth in fiscal revenues, aiding a lifetime of energy and economic security for Mozambicans.

To top that, it will be able to drive several gas-to-power projects, generate steady LNG production to meet diverse domestic use from ensuring clean cooking access and industrial development to gas export to the Southern African Development Community (SADC) region.

Located approximately 55 kms off the coast of Cabo Delgado province, the Coral North Floating Liquefied Natural Gas Project is a US$7bn plus investment by Italian major, Eni, in Mozambique. The major's interests in the region can push Mozambique to become an influential energy supplier in the global market at a time when the commodity is in high demand. Securing such a position will solidify the country's hold in SADC’s energy market.

As the Uganda National Oil Company aims to build a crude refinery, it has reached out to a unit of global commodities trader, Vitol, for a US$2bn loan to support the project alongside construction and infrastructure developments

According to Henry Musasizi, Uganda's junior finance minister, this seven-year tenor loan from Vitol Bahrain EC (VBA) comes with an interest rate of 4.92%. The minister worked on advancing the approval process for the credit line and the loan, which involved significant lawmakers, who sanctioned the development with a majority verdict.

Musasizi said that Vitol's support "presents an opportunity to access non-traditional financing to implement. ..projects and support the government in developing national infrastructure."

Vitol Bahrain EC has a long-standing presence in Uganda's downstream sector, functioning as the sole supplier of refined petroleum products to UNOC, before the state-owned company sells it to retailers across the country.

Alongside the refinery, the loan amount will also be covering road construction, a petroleum products storage terminal and extension of a petroleum pipeline from western Kenya to Uganda's capital Kampala.

Previously, the UNOC also concluded a deal with the UAE-based Alpha MBM Investments, whereby a domestic refinery with a capacity of 60,000 barrels per day is in the pipeline. The agreement accords 60% stake on the refinery to the UAE firm while UNOC retains 40%.

Uganda is looking to begin commercial oil generation starting next year from fields in its west.

Ovation Data, a global leader in data management and digital transformation, has announced its expansion into Africa, joining forces with the ETK Group

The partnership aims to tackle mounting concerns in global energy markets about the risks tied to non-digitised legacy data, particularly in African energy sectors.

The company’s latest industry survey, presented at IMAGE 2025 in Houston, highlights widespread concern about the preservation of legacy geological and geophysical data. The survey, which included significant input from African operators, regulators, and technical professionals, reveals a substantial gap in data readiness across the energy sector. In particular, it points to the growing challenge of non-digitised data in countries rich in exploration potential, like many across Africa.

“Effective data management means more than digitising archives,” said Gregory Servos, executive chairman of Ovation Data. “It involves collaborating closely with operators, regulators, and technical teams to recover historical data, capture its context, and respect the social and cultural dynamics unique to each market.” As energy projects focused on Carbon Capture and Storage (CCS), Liquefied Natural Gas (LNG), and the broader energy transition gain momentum, Ovation believes that securing data readiness will be critical for supporting operational efficiency and securing investments.

The survey’s results paint a concerning picture: 82% of respondents expressed fears about the permanent loss of legacy geological and geophysical data, while 50% highlighted project delays and incomplete data as serious concerns. Additionally, 61% of respondents feel that digitisation and data structuring aren’t receiving adequate investment or attention, and 12% remain unaware of the risks associated with holding non-digitised data.

The study also underscores a significant concern about losing undocumented knowledge as senior professionals retire or move on. “In Africa, this challenge extends beyond data trapped in obsolete formats,” Servos adds. “It’s also about preserving decades of technical insight, decision-making, and cultural context that will otherwise be lost when experienced professionals retire.”

ETK Group, with its deep understanding of African energy markets, will play a pivotal role in helping Ovation navigate the continent’s diverse and evolving landscape. Bolaji Sofoluwe MBE, managing director of ETK Group, said, “Africa’s energy sector offers immense potential, and data-driven solutions will be key to unlocking efficiency, regulatory compliance, and long-term sustainability.”

The findings of Ovation's survey serve as a wake-up call not only for Africa but for the global energy sector. As projects ranging from carbon storage to LNG development and renewable energy integration become more data-intensive, it’s evident that decades of seismic and well data must be preserved, accessible, and trusted.

Trudy Curtis, CEO of the PPDM Association, emphasises the importance of long-term stewardship in maintaining the value of energy data. “Without deliberate, intentional and sustained stewardship, these valuable assets are at risk of being lost, degraded, or rendered unusable,” she states.