In The Spotlight

This project underscores GTT’s central role in enabling major floating LNG developments in new markets.

GTT will be delivering the tank design of a new floating liquefied natural gas (FLNG) unit for Samsung Heavy Industries before it is ready for deployment in the African waters

The deal, which was made during the third quarter of 2025, will see GTT designing the cryogenic membrane containment system for the LNG storage tanks, with a total capacity of 238,700 cu/m. The tanks will be fitted with GTT’s Mark III technology.

This project underscores GTT’s central role in enabling major floating LNG developments in new markets and demonstrates how FLNG solutions can rapidly deliver offshore liquefaction capacity without relying on onshore infrastructure.

Philippe Berterottiere, chairman and CEO of GTT, said,“We are proud to contribute our unique expertise to this major FLNG project, which will help harness Africa’s energy potential to support sustainable growth and energy supply. This order confirms the trust of our long-standing partner Samsung Heavy Industries and demonstrates the relevance of GTT’s technologies to support the development of efficient, reliable and safe floating LNG infrastructure.”

The MoU was signed during the visit of Karim Badawi, Minister of Petroleum and Mineral Resources, and others. (Image source: bp)

bp has signed a Memorandum of Understanding to evaluate opportunities for a five-well programme at water depth ranging from 300 to 1,500 meters in the Mediterranean Sea

This will help plan the development of national gas reserves to optimise existing production facilities in the West Nile Delta. As the company aims to begin drilling operations in 2026, there are plans to explore the possibility of tie-back options after considering resource potential.

The MoU was signed during the visit of Karim Badawi, Minister of Petroleum and Mineral Resources; Ashraf Swelam, Egypt’s Ambassador to the UK, and Samir Raslan, Undersecretary for Exploration and Agreements at the Ministry of Petroleum and Mineral Resources, to bp’s headquarters in London.

The delegation met with Murray Auchincloss, bp’s chief executive officer; William Lin, executive vice president for gas and low carbon energy; Nader Zaki, regional president, Middle East and North Africa; and Wail Shaheen, president of bp Egypt.

“Today’s announcement reaffirms our commitment to supporting investment in Egypt’s gas sector. We appreciate the continued engagement and support from HE Minister Karim Badawi. We look forward to applying bp’s technological expertise to build on our recent exploration and development momentum to bring on new gas resources and accelerated production for the country as well as deliver value for our business,” said Lin.

Zaki added,“We are proud of our longstanding partnership with the Egyptian government. This memorandum represents a strategic step in our investments in Egypt’s energy sector during this decade, enabling us to develop additional gas resources in the West Nile Delta and bring them onstream as quickly as possible to meet the needs of the local market.”

The agreement comes as bp plans to increase production to 2.3-2.5 million barrels of oil equivalent a day in 2030 with the capacity to increase production out to 2035. It follows a successful exploration campaign in the first half of 2025 in which bp has made 10 discoveries including two in Egypt, where it completed drilling activity at the Fayoum-5 gas discovery well and El King-2 exploration well, both part of the West Nile Delta development.

As the Republic of Congo targets increasing production by 200,000 barrels per day by 2030, it has closed a US$23bn agreement on three permits with Chinese company, Wing Wah

Involving the integrated development of the Banga Kayo, Holmoni and Cayo permits, the agreement was officially signed by Bruno Jean-Richard Itoua, Minister of Hydrocarbons of Congo; Jean-Jacques Bouya, Minister of State of Congo, and Xiao Lianping, president general, Wing Wah in August.

This pact can ramp up cumulative production across the three permits to more than 1.3 billion barrels by 2050.

There will be an integrated gas monetisation component as well, with multi-phase expansion of LNG, LPG, butane and propane production capacity–intended to satisfy both domestic demand and exports. The integrated nature of the development includes scalable gas treatment infrastructure, on-site power generation and water-management systems–all designed for efficiency and community benefit.

The initiative generates employment for around 3,300 Congolese workers.

AOW Energy

Dates: 15-18 September

Venue: Accra

Website: https://www.aowenergy.com/

The MoU was signed during the visit of Karim Badawi, Minister of Petroleum and Mineral Resources, and others. (Image source: bp)

bp has signed a Memorandum of Understanding to evaluate opportunities for a five-well programme at water depth ranging from 300 to 1,500 meters in the Mediterranean Sea

This will help plan the development of national gas reserves to optimise existing production facilities in the West Nile Delta. As the company aims to begin drilling operations in 2026, there are plans to explore the possibility of tie-back options after considering resource potential.

The MoU was signed during the visit of Karim Badawi, Minister of Petroleum and Mineral Resources; Ashraf Swelam, Egypt’s Ambassador to the UK, and Samir Raslan, Undersecretary for Exploration and Agreements at the Ministry of Petroleum and Mineral Resources, to bp’s headquarters in London.

The delegation met with Murray Auchincloss, bp’s chief executive officer; William Lin, executive vice president for gas and low carbon energy; Nader Zaki, regional president, Middle East and North Africa; and Wail Shaheen, president of bp Egypt.

“Today’s announcement reaffirms our commitment to supporting investment in Egypt’s gas sector. We appreciate the continued engagement and support from HE Minister Karim Badawi. We look forward to applying bp’s technological expertise to build on our recent exploration and development momentum to bring on new gas resources and accelerated production for the country as well as deliver value for our business,” said Lin.

Zaki added,“We are proud of our longstanding partnership with the Egyptian government. This memorandum represents a strategic step in our investments in Egypt’s energy sector during this decade, enabling us to develop additional gas resources in the West Nile Delta and bring them onstream as quickly as possible to meet the needs of the local market.”

The agreement comes as bp plans to increase production to 2.3-2.5 million barrels of oil equivalent a day in 2030 with the capacity to increase production out to 2035. It follows a successful exploration campaign in the first half of 2025 in which bp has made 10 discoveries including two in Egypt, where it completed drilling activity at the Fayoum-5 gas discovery well and El King-2 exploration well, both part of the West Nile Delta development.

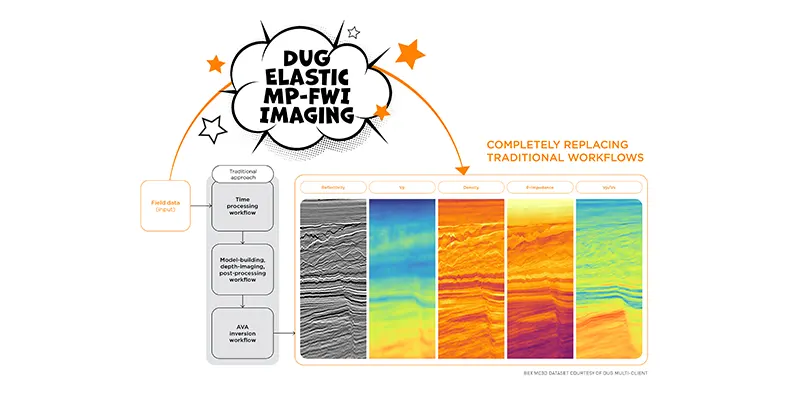

DUG Elastic MP-FWI Imaging is a unique approach to seismic processing and imaging. (Image source: DUG)

DUG has released the latest results from its elastic multi-parameter full waveform inversion (MP-FWI) imaging technology which it launched in 2022, since when more than 70 successful projects have been completed worldwide

DUG Elastic MP-FWI Imaging is a unique approach to seismic processing and imaging which is not only a complete replacement for the traditional processing and imaging workflows, it also replaces the subsequent inversion workflow for elastic rock properties.

With the traditional processing workflow, projects can take many months to years to complete. It involves the testing and application of dozens of steps such as deghosting, designature, demultiple and regularisation, all designed to overcome the limitations of conventional imaging. These workflows are complex, subjective, and very time-consuming and they rely on many assumptions and simplifications. All of these issues impact the output data quality. The resulting, primary-only data then undergoes a similarly complex model-building workflow to derive an estimate of the subsurface velocity, which is used for depth imaging. Post-migration processing is performed before the pre-stack reflectivity undergoes another workflow to derive rock properties that feed into interpretation, also relying on simplifications of the actual physics.

As well as three-component reflectivity and velocity, DUG Elastic MP-FWI Imaging enables the estimation of fundamental rock properties like P-impedance, density and Vp/Vs from field data, without the need for a secondary amplitude variation with angle (AVA) inversion step. DUG Elastic MP-FWI Imaging simultaneously resolves not only subsurface structural features but also quantitative rock property information while avoiding the need for extensive data pre-processing and (post-imaging) AVA-inversion workflows.

“Elastic MP-FWI Imaging accounts for both compressional and shear waves, handling variations in seismic wave dynamics as a function of incidence angle, including in the presence of high impedance contrasts and onshore near-surface geological complexity,” said Tom Rayment, DUG chief geophysicist. “Multiples and converted waves are now treated as valuable additional signal, increasing sampling, resolution and constraining the inverted parameters.”

DUG managing director, Dr Matthew Lamont, added, “We have invested over a decade of R&D to realise this opportunity. Our new Elastic MP-FWI Imaging technology is the product of a multi-year, significant and ongoing R&D effort, which has seen the continuous integration of complete-physics FWI imaging including viscoelasticity, anisotropy and multi-parameter updates. When using the full wavefield for simultaneous velocity model building, rock property inversion and true-amplitude imaging, a multi-parameter solution is a necessity.”

“The fact that DUG MP-FWI Imaging is delivering material imaging uplifts using field-data input is very powerful, but to couple this with high-resolution elastic rock property outputs for quantitative interpretation is even more exciting, providing immediate opportunities for new surveys and maximising the value of legacy datasets,” said Martin Stupel, geophysical manager, Geophysical Pursuit Inc.

MODEC has executed a co-operation agreement with infrastructure solutions provider, Africa Finance Corporation, to collaborate on floating production, storage, and offloading (FPSO) units projects as well as other maritime infrastructure projects in Africa

MODEC has extensive African experience, having delivered 11 FPSOs/FSOs, MOPU and TLPs in West Africa in the past. Currently MODEC is providing charter service for FPSO.

AFC is a multilateral financial institution, established in 2007 to be the catalyst for pragmatic infrastructure and industrial investments across Africa. With 45 member countries and having invested over US$15bn across the continent, AFC’s approach combines specialist industry expertise with a focus on financial and technical advisory, project structuring, project development, and risk capital to address Africa’s infrastructure development needs.

This CA is a framework aiming at future cooperation and information exchange in technical studies, market studies, structuring of finance solutions and sourcing of potential projects for future maritime infrastructure space in Africa.

MODEC group president and CEO, Hirohiko Miyata, said, “We are honoured and excited to execute the CA with AFC. Africa is a core market for us with infinite potential for offshore development. MODEC is committed to supporting the development of African countries through our offshore solutions.”

This agreement, signed during AFC’s visit to Japan for the 9th Tokyo International Conference on African Development, marks a significant step for both companies as they work together to contribute to the sustainable development of maritime infrastructure and economic growth in Africa, thereby supporting the advancement of local communities.

As energy demand continues to grow, Middle East-based natural gas company, Dana Gas PJSC, has confirmed commercial gas presence onshore Nile Delta in Egypt, in line with its US$100mn investment programme to support gas production

Initial results from drilling and logging the Begonia-2 appraisal well, which is the first of the 11 appraisal and exploration wells under the Begonia development area, have suggested the presence of 9 bn cu/ft of gas estimates that is likely to increase further. Drilling continues with the EDC-54 rig, and the next well is set to spud in August.

Profits from the Begonia development will significantly contribute to the company's million dollar gas programme, adding approximately 80 bn cu/ft in recoverable gas reserves over the course of the two-year plan.

Located in the New El-Manzala concession and operated by the joint venture, El-Wastani Patrolmen Company (Wasco), the Begonia-2 well generates an additional 5 mn cu/ft gas per day from enhanced recovery practices.

Egypt's Ministry of Petroleum and Mineral Resources is especially enthusiastic of the project, anticipating its domestic natural gas production potential. The government is also banking on the project's contribution towards solidifying the national energy system and driving economic development.

To boost and maintain production count, the company is focusing on well recompletions in other geological layers too. The Egyptco rig which was in plug and abandonment mode has been redeployed by the company for recompletion activities in the Balsam-3 well. Output enhancement besides, the recompletion eliminated the risks that accompany drilling exploration wells. It generated a total 4 bn cu/ft of gas while ensuring an additional yield of 3 mn cu/ft of gas per day.

Richard Hall, CEO, Dana Gas, said, “The successful drilling of the appraisal well 'Begonia-2' and the recompletion of the ‘Balsam-3’ well marks a significant strategic milestone. It signals the first steps in our ambitious US$100mn investment programme in Egypt, which includes drilling 11 new wells. We have been developing and producing gas in Egypt for over a decade, and the signing of the concession area consolidation agreement with the Egyptian Natural Gas Holding Company (EGAS) late last year has allowed us to acquire additional areas under improved financial terms, enabling us to launch this new phase.

"The success of drilling this well opens vast prospects for gas production in the 'Begonia' area and presents promising future opportunities for expansion and growth. It will also extend the operational life of our assets in Egypt. We are fully committed to making every effort to ensure the success of the programme and its efficient and timely execution. Dana Gas reaffirms its strong

commitment to reinvesting the payments it receives from the Egyptian government into executing this ambitious programme and supporting future development projects in the country. Regular and timely payments from our partners are crucial to sustaining these investments.”

As part of production optimisation strategy, the Republic of Congo is advancing investments on infrastructure development

With aims to expand the container terminal at the Port of Pointe Noire, a €230mn in financing has been generated to onboard freight forwarding service Africa Global Logistics (AGL) for the project.

The new 750-meter quay – scheduled for completion by 2027 – will double the terminal’s capacity to 2.3 million containers annually and support the country’s growing oil and LNG exports.

The Pointe Noire project is being executed by AGL’s subsidiary Congo Terminal in collaboration with engineering firm China Road and Bridge Corporation. Backed by both international and Congolese banks, the €400mn platform will include 26 hectares of quayside, a dredged 17-meter-deep basin, and the installation of 16 gantries. It forms a key part of Congo’s strategy to boost hydrocarbon production to 500,000 barrels of oil per day and LNG output to 3 million tons per annum within five years.

In Angola, AGL also launched operations at its Lobito Terminal in March last year. The terminal – Angola’s second-largest port hub – handles over one million tons of bulk cargo and more than 100,000 20-ft equivalent unit containers annually, with 730 employees operating deepwater berths and modern equipment. The project comes at a pivotal time for Angola, which is preparing to bring several major energy developments online between 2025 and 2028. These include the Cabinda Oil Refinery in 2025, the Agogo Integrated West Hub development in late-2025, the Quiluma and Maboqueiro gas fields in 2026 and the Kaminho Deepwater Development in 2028.

Meanwhile, in Ivory Coast, AGL is playing a vital role in Phase 2 of the Baleine offshore development - West Africa’s first net-zero emissions project. In partnership with engineering firm Saipem, AGL began manufacturing critical subsea structures for the Baleine field in April 2024 at its Carena shipyard in Abidjan. The works include anchoring systems and underwater fixtures totaling over 200 tons, to be deployed in ultra-deep waters. AGL has mobilized 100 skilled local workers – including certified welders, painters and crane operators – reinforcing its commitment to local content, capacity building and sustainable energy infrastructure in Ivory Coast’s rapidly growing oil and gas sector.

AGL’s recent activities in Africa align with its broader vision to support the continent’s energy infrastructure. In addition to the Republic of Congo, Angola and Ivory Coast, the company is currently modernising the Walvis Bay terminal in Namibia while playing a key role in major energy logistics across Mauritania, Senegal and Mozambique.

AOW:Energy 2025 will serve as a platform to spotlight Ghana’s strategic assets. (Image source: Adobe Stock)

Ghana is set to host the 31st edition of AOW:Energy, the flagship event for Africa’s oil, gas, and energy sector, from 15th to 18th September 2025 in Accra, under the auspices of the Ministry of Energy and Green Transition and the Petroleum Commission

It is the first time in over three decades that the event will be held outside Cape Town, South Africa. As regulator of Ghana’s upstream petroleum industry, with a strategic vision of positioning Ghana as a competitive upstream petroleum hub, the Commission views the AOW: Investing in African Energy as a notable opportunity to further raise awareness of the country’s hydrocarbon potential on the global stage.

“We have an opportunity to present a dedicated national showcase, where His Excellency President H.E John Dramani Mahama will outline his vision for positioning the country as one of the most attractive upstream destinations with good geological prospects, through a progressive fiscal regime, regulations, investor-friendly incentives, and forward-thinking energy policies,” noted Emeafa Hardcastle, Ag. CEO of the Petroleum Commission. “AOW:Energy 2025 will serve as a platform to spotlight Ghana’s strategic assets, engage with global investors, build critical partnerships and offer regulators across the continent an opportunity to present emerging regulatory reforms that will shape the continent’s energy future.”

Paul Sinclair, CEO of AOW:Energy, expressed enthusiasm for the momentum building around the event, noting a record level of government and private sector participation. “We are excited about the strong support from the Ghana government in welcoming ministers, national oil companies, regulators and global investors to AOW:Energy 2025. Africa is quickly becoming a top destination for energy investment, and 2025 will be a year for the continent’s upstream sector. Ghana, I believe is ready to take the spotlight when AOW:Energy comes to Accra,” he said.

As AOW:Energy evolves, it continues to consolidate its founding mission of bringing together a powerful network of governments, national oil companies, regulators, energy agencies, and private sector players.

The 2025 edition is expected to open new doors to investment, innovation, and collaboration, providing direct access to emerging opportunities across Africa’s energy landscape.