In The Spotlight

The companies' continued collaboration will fundamentally reshape Nigeria’s energy landscape. (Image source: Heirs Energy)

Heirs Energies Limited and Renaissance Africa Energy Company have expressed mutual commitment to strategic collaboration following a high-level courtesy visit by Osa Igiehon, CEO of Heirs Energies, to Renaissance’s leadership team, led by Tony Attah

The meeting, which marked the first formal engagement between the two companies post-Renaissance’s successful transition, focused on mutual priorities and shared commitment to advancing Nigeria’s oil and gas sector through indigenous leadership and innovation.

Speaking during the visit, Osa Igiehon emphasised the significance of indigenous companies leading Nigeria’s energy transformation. “We are happy to connect with the leadership of Renaissance and congratulate them on their successful deal and transition,” said Igiehon. “As indigenous firms, we all have a duty to the continued development of the industry. The thinking and how we approach things will be different now, as we’re both indigenous companies committed to Nigerian excellence and driving unprecedented production growth.”

The CEO highlighted the natural synergy between the two organiations and the transformative potential of their collaboration. “Heirs Energies and Renaissance are closely linked, and we’re looking forward to continued collaboration that will not only benefit our companies, but fundamentally reshape Nigeria’s energy landscape. Together, we have the capability and commitment to accelerate production across our assets and drive the kind of innovation that will position Nigeria as a global energy leader.”

Tony Attah, Managing Director of Renaissance Africa Energy Company, expressed enthusiasm for the partnership, stating: “We are equally happy to connect and engage with Heirs Energies. This collaboration represents a significant step forward as we pursue our shared vision for the industry.”

He emphasised Renaissance’s commitment to driving transformational change across the energy value chain, “Renaissance is on a journey to drive increased production and development across the entire value chain, and partnering with like-minded indigenous companies like Heirs Energies is fundamental to achieving these objectives.”

The collaboration between these two leading indigenous energy companies signals a new era of homegrown expertise and innovation in Nigeria’s oil and gas sector. Both companies bring complementary strengths and shared values that position them to accelerate production growth through innovative approaches, develop local capacity and expertise across the energy value chain, drive sustainable industry practices that benefit Nigerian communities, leverage indigenous knowledge and understanding of local operating environments, and create synergies that enhance operational efficiency and market competitiveness.

Heirs Energies Limited is Africa’s leading indigenous-owned integrated energy company, committed to meeting Africa’s unique energy needs while aligning with global sustainability goals. Having a strong focus on innovation, environmental responsibility, and community development, Heirs Energies leads in the evolving energy landscape and contribute to a more prosperous Africa.

The PetroWeb-operated West El Burullus Gas Field Development Project in Idku saw the installation of the WEB Offshore Platform by Petroleum Marine Services

A massive marine unit, barge PMS 12 and several specialised supported vessels were used to facilitate the installation. After the deployment of a 345-tons jacket, a deck weighing 431 tons was installed as well.

This installation advances Egypt's Ministry of Petroleum and Natural Resources towards its production optimisation goals.

The future installation of a second platform called Papyrus will further boost this goal.

Earlier the West El Burullus project underwent the placement of an 8-inch subsea pipeline, also spearheaded by PMS 11, which is specifically designed for subsea pipeline laying and platform installation.

This will be followed by the laying of a 14-inch pipeline, with total length 32 kms.

PMS has driven major national projects across both the Red Sea and the Mediterranean, including its contributions to the development of giant gas fields most notably Phases 10 and 11 of the West Delta Deep Marine (WDDM) Gas Field Development.

Afentra has entered into a SPA with Etu for its 50% share of the acquisition. (Image source: Adobe Stock)

Afentra will jointly acquire, alongside Etablissements Maurel & Prom S.A. (M&P), Etu Energias SA 10% interest in Blocks 3/05 and 13.33% interest in Block 3/05A offshore Angola

The company has entered into a sale and purchase agreement with Etu for its 50% share of the acquisition, awaiting customary conditions including government approval.

With this acquisition, Afentra is prioritising restoring the very material upside of this multi-billion barrel offshore asset through a solid joint venture partnership. It is focusing on consistent value creation through disciplined transaction structures, combining modest upfront consideration with success-based contingent payments aligned to oil price and asset performance.

Paul McDade, chief executive officer of Afentra plc, said, "We are pleased to have signed this SPA with Etu Energias, providing Afentra with additional interest on similar terms to our previous transactions in Blocks 3/05 and 3/05A. This transaction enhances the alignment within the joint venture and reinforces our exposure to these high-quality production and development assets that continue to perform strongly as the partners demonstrate the ability to realise the upside of these world-class assets. The structure of the transaction reflects our disciplined approach to capital deployment, combining a modest upfront payment with a value-linked contingent consideration. We look forward to continuing to work closely with Sonangol and M&P to deliver the material upside in these assets providing long-term value for all stakeholders."

The Cabora Bassa Project will be receiving National Project Status (NPS). (Image source: Adobe Stock)

Invictus Energy Limited's Petroleum Production Sharing Agreement (PPSA) for its 80%-owned and operated Cabora Bassa Project in Zimbabwe has been consolidated with the Petroleum Exploration Development and Production Agreement (PEDPA) to ensure long-term results

This comes following close cooperation with the relevant line ministries to finalise the terms of the PPSA. The consolidation will ensure robust, balanced, and transparent agreement that meets international standards.

The Cabora Bassa Project will be receiving National Project Status (NPS) from the Ministry of Finance, recognising its potential to deliver broad-based economic benefits, attract foreign investment, and create employment. This will unlock for Invictus a suite of fiscal and non-fiscal incentives including duty exemptions, fast-tracked permitting, and streamlined access to key infrastructure and services.

Invictus is progressing the contracting and procurement of long lead items and critical services in preparation for the Musuma-1 exploration well, scheduled to spud in the second half of 2025.

Mthuli Ncube, Zimbabwe's Minister of Finance, said, “The Cabora Bassa Project is a nationally significant development, and we are working closely with Invictus to finalise the PPSA and ensure a transparent, fair and commercially sound agreement. The Government looks forward to the successful formalisation of National Project Status and the long-term benefits the project will bring to Zimbabwe.”

Invictus managing director, Scott Macmillan, said, “We are greatly encouraged by the Government’s continued support and the positive momentum towards finalising the PPSA. The Ministry of Finance’s agreement to provide National Project Status is a key milestone, and we look forward to completing the formalities in due course. We remain on track with preparations for Musuma-1 and are excited about the next phase of activity at Cabora Bassa.”

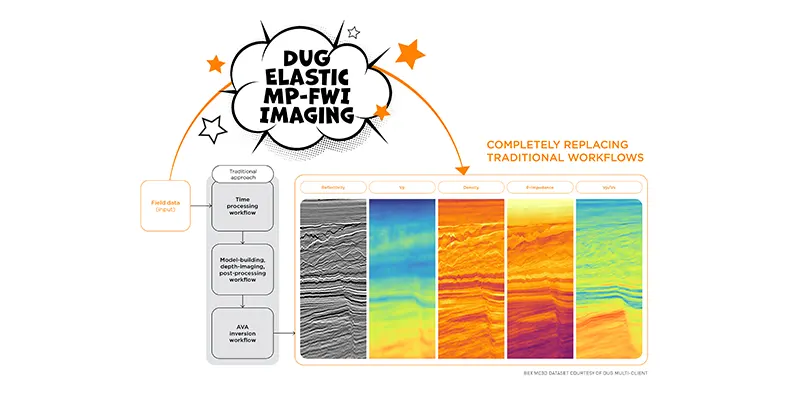

DUG Elastic MP-FWI Imaging is a unique approach to seismic processing and imaging. (Image source: DUG)

DUG has released the latest results from its elastic multi-parameter full waveform inversion (MP-FWI) imaging technology which it launched in 2022, since when more than 70 successful projects have been completed worldwide

DUG Elastic MP-FWI Imaging is a unique approach to seismic processing and imaging which is not only a complete replacement for the traditional processing and imaging workflows, it also replaces the subsequent inversion workflow for elastic rock properties.

With the traditional processing workflow, projects can take many months to years to complete. It involves the testing and application of dozens of steps such as deghosting, designature, demultiple and regularisation, all designed to overcome the limitations of conventional imaging. These workflows are complex, subjective, and very time-consuming and they rely on many assumptions and simplifications. All of these issues impact the output data quality. The resulting, primary-only data then undergoes a similarly complex model-building workflow to derive an estimate of the subsurface velocity, which is used for depth imaging. Post-migration processing is performed before the pre-stack reflectivity undergoes another workflow to derive rock properties that feed into interpretation, also relying on simplifications of the actual physics.

As well as three-component reflectivity and velocity, DUG Elastic MP-FWI Imaging enables the estimation of fundamental rock properties like P-impedance, density and Vp/Vs from field data, without the need for a secondary amplitude variation with angle (AVA) inversion step. DUG Elastic MP-FWI Imaging simultaneously resolves not only subsurface structural features but also quantitative rock property information while avoiding the need for extensive data pre-processing and (post-imaging) AVA-inversion workflows.

“Elastic MP-FWI Imaging accounts for both compressional and shear waves, handling variations in seismic wave dynamics as a function of incidence angle, including in the presence of high impedance contrasts and onshore near-surface geological complexity,” said Tom Rayment, DUG chief geophysicist. “Multiples and converted waves are now treated as valuable additional signal, increasing sampling, resolution and constraining the inverted parameters.”

DUG managing director, Dr Matthew Lamont, added, “We have invested over a decade of R&D to realise this opportunity. Our new Elastic MP-FWI Imaging technology is the product of a multi-year, significant and ongoing R&D effort, which has seen the continuous integration of complete-physics FWI imaging including viscoelasticity, anisotropy and multi-parameter updates. When using the full wavefield for simultaneous velocity model building, rock property inversion and true-amplitude imaging, a multi-parameter solution is a necessity.”

“The fact that DUG MP-FWI Imaging is delivering material imaging uplifts using field-data input is very powerful, but to couple this with high-resolution elastic rock property outputs for quantitative interpretation is even more exciting, providing immediate opportunities for new surveys and maximising the value of legacy datasets,” said Martin Stupel, geophysical manager, Geophysical Pursuit Inc.

Energy technology company, SLB has launched Sequestri carbon storage solutions for the most effective project delivery

Since long-term carbon storage demands a calculated approach, the new portfolio gives customised hardware and digital workflows for improved decision-making across the full carbon storage value chain, from site selection and planning to development, operations and monitoring.

“Advanced technology solutions have a crucial role to play in shifting the economics and safeguarding the integrity of carbon storage projects,” said Katherine Rojas, SLB’s senior vice president of Industrial Decarbonisation. “The Sequestri portfolio offers a comprehensive suite of solutions that provide the precision, reliability and efficiency needed to advance carbon storage projects at every stage of their lifecycle — driving meaningful progress toward industrial decarbonisation at scale.”

The Sequestri portfolio is anchored by a network of interconnected digital technologies and services for carbon storage that provide a robust foundation for analysis and prediction. These end-to-end digital technologies harness more than 25 years of carbon capture and storage (CCS) project experience to help developers screen, rank, design, model, simulate and analyse every phase of the project lifecycle. The portfolio also includes a range of technologies which have been specifically engineered and qualified for carbon storage applications, from subsurface safety valves and measurement tools to cementing systems, including SLB’s EverCRETE CO2-resistant cement system.

The Sequestri portfolio of carbon storage solutions, together with the SLB Capturi standard, modular carbon capture solutions, provide emitters and project developers with a full suite of complementary CCS solutions to enable decarbonisation at scale from point of capture to permanent carbon storage.

The FLNG Gimi by Golar LNG Limited has reached commercial operations date (COD) for the 20-year lease and operate agreement with bp for the Greater Tortue Ahmeyim (GTA) project offshore Mauritania and Senegal

This marks a significant milestone for the project partners, as LNG production volumes have successfully been ramped up to a level equivalent to the annual contracted volumes of approximately 2.4 million tonnes per annum (mtpa), or around 90% of nameplate capacity of 2.7mtpa.

The achievement of COD follows first LNG in February and the first LNG cargo in April. The second and third LNG cargo were exported in May and early June respectively and a fourth cargo is currently loading. The fifth cargo is expected at the start of the third quarter. With this expected cargo timing, Kosmos Energy forecasts 3.5 gross cargos in the second quarter.

Achieving COD and the recent ramp up in cargo lifting activity highlights continued strong cooperation between the project partners and Golar.

As part of production optimisation strategy, the Republic of Congo is advancing investments on infrastructure development

With aims to expand the container terminal at the Port of Pointe Noire, a €230mn in financing has been generated to onboard freight forwarding service Africa Global Logistics (AGL) for the project.

The new 750-meter quay – scheduled for completion by 2027 – will double the terminal’s capacity to 2.3 million containers annually and support the country’s growing oil and LNG exports.

The Pointe Noire project is being executed by AGL’s subsidiary Congo Terminal in collaboration with engineering firm China Road and Bridge Corporation. Backed by both international and Congolese banks, the €400mn platform will include 26 hectares of quayside, a dredged 17-meter-deep basin, and the installation of 16 gantries. It forms a key part of Congo’s strategy to boost hydrocarbon production to 500,000 barrels of oil per day and LNG output to 3 million tons per annum within five years.

In Angola, AGL also launched operations at its Lobito Terminal in March last year. The terminal – Angola’s second-largest port hub – handles over one million tons of bulk cargo and more than 100,000 20-ft equivalent unit containers annually, with 730 employees operating deepwater berths and modern equipment. The project comes at a pivotal time for Angola, which is preparing to bring several major energy developments online between 2025 and 2028. These include the Cabinda Oil Refinery in 2025, the Agogo Integrated West Hub development in late-2025, the Quiluma and Maboqueiro gas fields in 2026 and the Kaminho Deepwater Development in 2028.

Meanwhile, in Ivory Coast, AGL is playing a vital role in Phase 2 of the Baleine offshore development - West Africa’s first net-zero emissions project. In partnership with engineering firm Saipem, AGL began manufacturing critical subsea structures for the Baleine field in April 2024 at its Carena shipyard in Abidjan. The works include anchoring systems and underwater fixtures totaling over 200 tons, to be deployed in ultra-deep waters. AGL has mobilized 100 skilled local workers – including certified welders, painters and crane operators – reinforcing its commitment to local content, capacity building and sustainable energy infrastructure in Ivory Coast’s rapidly growing oil and gas sector.

AGL’s recent activities in Africa align with its broader vision to support the continent’s energy infrastructure. In addition to the Republic of Congo, Angola and Ivory Coast, the company is currently modernising the Walvis Bay terminal in Namibia while playing a key role in major energy logistics across Mauritania, Senegal and Mozambique.

As Africa is zooming in on brownfield sites for maximum oil recovery, artificial intelligence and machine learning technologies are fuelling the industry's optimisation goals

Redifining operational efficiency by extending field life and maximising output, AI is set to move the oil and gas industry at a US$6.4bn market value by 2030.

As major operators increasingly adopt AI, global oilfield technology companies like Baker Hughes, Halliburton or SLB have opened bases in Africa. SLB's technology is backing several billion-dollar oil projects in Angola, and has introduced the Africa Performance Centre in Luanda this year. It has a strong presence in other regions of Africa as well.

Repsol has several developments underway in Libya, Algeria and Morocco and strives to bolster production across these markets.

Enhanced oil recovery is currently witnessing a disruption as AI has unlocked access to large datasets which is unimaginable with traditional systems. This makes a huge difference for operators in taking the right decisions. With deep geological and production data in hand, reservoir management and pattern identification become much simpler.

AI is now way past the experimental stage, and is being adopted on a policy level as well. Many African countries are streamlining policy to support EOR at legacy assets. Angola, for example, implemented its Incremental Production Initiative in 2024 which offers tax incentives to encourage reinvestments in mature oilfields. Energy major ExxonMobil made the first discovery – the Likembe-01 well - as part of the initiative in 2024, demonstrating the role policy plays in unlocking incremental resources. The African Union Commission also declared AI as a strategic priority for the continent in May 2025, citing the role machine-learning plays in transforming the continent’s development trajectory.

These topics will drive conversations at the African Energy Week (AEW): Invest in African Energies 2025 that will be taking place from 29 September 29 to 3 October in Cape Town.