In The Spotlight

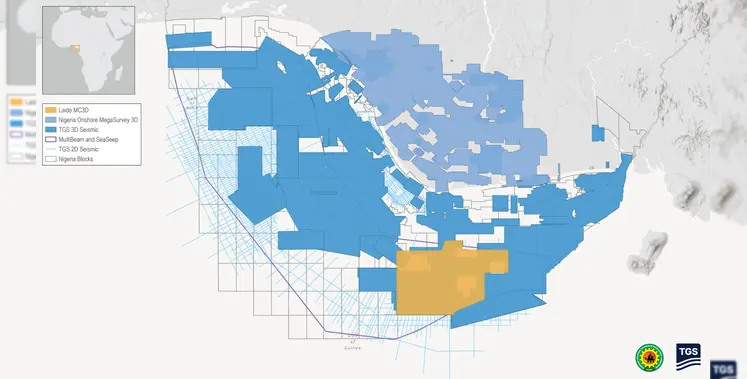

As Nigeria continues to build its domestic industry to attract global investors, seismic surveys remain an integral part of the process

The latest research comes from the eastern Niger Delta, which is considered one of the country's most prolific hydrocarbon regions, covering approximately 11,700 sq kms. The Nigerian Upstream Petroleum Regulatory Commission has partnered with TGS and SeaSeis Geophysical Limited to announce the Nigeria Laide multi-client 3D survey, which focuses within the outer fold and thrust belt of the deepwater eastern Niger Delta. This area is marked with complex geological challenges such as stacked toe-thrust structures, elongate anticlines (e.g. Bolia–Chota), inner fold-and-thrust-belt geometries, and shale diapirs/mud volcanoes.

These are addressed with the help of GeoStreamer dual-sensor system, long offsets, wide tow, and a triple-source configuration that are capable of generating modern broadband seismic data to support full-integrity PSTM and Q-PSDM through advanced Elastic FWI-driven velocity model building. This makes it easy for operators and explorers to finalise the next steps based on precisely acquired insights from otherwise inaccessible and challenging zones.

"Nigeria continues to play a crucial role in the global supply of oil and gas. The expansion of our multi-client library in Nigeria in partnership with the government through the Laide 3D showcases our commitment to furthering hydrocarbon exploration in the region. By utilising industry-trusted acquisition solutions, TGS provides insights that accelerate exploration activity and allow operators to fulfil their exploration ambitions," said Kristian Johansen, CEO of TGS.

The modern, high-fidelity Nigeria Laide multi-client 3D survey is backed by industry funding, and comes soon after a survey in the western Niger Delta Basin that was announced by Shearwater last December.

VAALCO Energy has reported of a positive financial year for 2025 in Gabon and Cote d’Ivoire

In Gabon, it has successfully drilled, completed and placed on production the Etame 15H-ST development well in the 1V block of the Etame field, with a lateral of 250 meters of net pay in high-quality Gamba sands near the top of the reservoir.

In West Etame a step out exploration well that has been spudded promises 57% geologic prospects, leading to anticipation towards a strong production and reserves report for VAALCO in 2026.

In Ivory Coast, VAALCO is now the operator with a 60% working interest in the Kossipo field on the CI-40 Block with a field development plan expected to be completed in second half of 2026.

George Maxwell, Vaalco’s Chief Executive Officer, said, “We have begun 2026 with some very meaningful events that are positioning Vaalco to deliver expected 225% organic production growth by 2030. We have been confirmed as the operator with a 60% working interest in the Kossipo field, a discovery with an estimated 293 MMBOE in place located southwest from our highly productive Baobab field on the CI-40 Block. We are actively working with our partner PetroCI to submit an FDP in the second half of 2026 that we believe will help Vaalco grow its production in Cote d’Ivoire. We are also pleased with the encouraging start of the Gabon drilling campaign, the ET-15H-ST which stabilized at approximately 2,000 BOPD. The rig has remained on the Etame platform and is now drilling an exploration prospect in West Etame, that has a 57% chance of geological success and if successful could add production and additional reserves in Gabon. With the Baobab FPSO on track to return to the field and commence production in Q2 2026, coupled with the Gabon drilling campaign, we are looking to drive meaningful growth that we believe will translate into value for our shareholders in 2026 and beyond.”

In terms with an agreement in place, Panoro Energy has acquired 40.375% non-operating working interest in the Ceiba Field and Okume Complex production assets offshore Equatorial Guinea

Alongside future contingent payments that add up to US$39.5mn, the transaction is worth US$180mn.

This will give Panoro ownership of interests in Block G, with contingent payments of US$12.5mn linked to production performance at the Ceiba field and US$9mn payable in each of 2027, 2028 and 2029, subject to price and production volatilities.

The transaction enhances liquidity from monetising non-core assets and accelerates debt reduction for Kosmos. Proceeds will be used to reduce borrowings outstanding under the reserves-based lending (RBL) credit facility.

Put in place during January, the transaction process will be through mid-year. It has been approved by the Government of Equatorial Guinea, and completion only remains subject to CEMAC customary approval. Over the two-year period post completion of the transaction, Kosmos expects to realise approximately US$100mn in total savings across capital expenditures and general and administrative expenses.

Andrew G Inglis, Kosmos Energy’s chairman and chief executive officer said, “This transaction reflects our continued focus on capital discipline and balance sheet resilience. The high-grading of the portfolio by accelerating the monetisation of later-life, non-operated production assets enables Kosmos to focus our capital and expertise on our world-class assets where we can add the most value for our stakeholders over the long-term. The proceeds from the transaction enhance liquidity and accelerate debt reduction, while the contingent payments ensure we retain exposure to future upside.”

In terms with an agreement in place, Panoro Energy has acquired 40.375% non-operating working interest in the Ceiba Field and Okume Complex production assets offshore Equatorial Guinea

Alongside future contingent payments that add up to US$39.5mn, the transaction is worth US$180mn.

This will give Panoro ownership of interests in Block G, with contingent payments of US$12.5mn linked to production performance at the Ceiba field and US$9mn payable in each of 2027, 2028 and 2029, subject to price and production volatilities.

The transaction enhances liquidity from monetising non-core assets and accelerates debt reduction for Kosmos. Proceeds will be used to reduce borrowings outstanding under the reserves-based lending (RBL) credit facility.

Put in place during January, the transaction process will be through mid-year. It has been approved by the Government of Equatorial Guinea, and completion only remains subject to CEMAC customary approval. Over the two-year period post completion of the transaction, Kosmos expects to realise approximately US$100mn in total savings across capital expenditures and general and administrative expenses.

Andrew G Inglis, Kosmos Energy’s chairman and chief executive officer said, “This transaction reflects our continued focus on capital discipline and balance sheet resilience. The high-grading of the portfolio by accelerating the monetisation of later-life, non-operated production assets enables Kosmos to focus our capital and expertise on our world-class assets where we can add the most value for our stakeholders over the long-term. The proceeds from the transaction enhance liquidity and accelerate debt reduction, while the contingent payments ensure we retain exposure to future upside.”

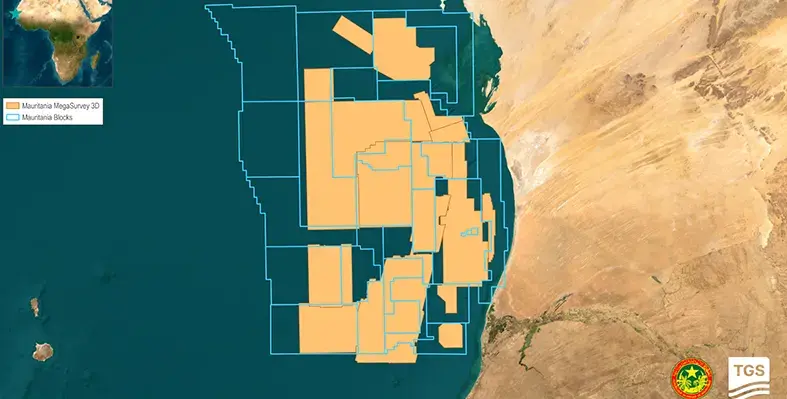

Energy data and intelligence provider, TGS, has tapped offshore Mauritania and the wider West African Atlantic Margin for a large-scale multi-client 3D seismic project called the Mauritania MegaSurvey

With this initiative, TGS has secured more than 100,000 contiguous square kilometers of modern seismic data, which will add to its existing offshore Mauritania multi-client library. Strategically positioned for extension and integration, the move will allow TGS to give operators easy and one-stop access across the offshore of Mauritania, making possible the regional interpretation of the full source to sink from nearshore to the ultradeep.

For an informed portfolio decision-making, operators can interpret complex regional-scale seismic with continuity across multiple exploration plays, simplifying robust basin screening and prospect maturation. The MegaSurvey's harmonised 3D seismic dataset over a large contiguous area eliminates uncertainties by ensuring confident geological interpretation backed by the clarity of structural and stratigraphic frameworks. Companies can leverage the survey for de-risking acreage evaluation before going ahead with drilling or licensing decisions.

TGS’ interests in the Mauritanian offshore is supported by the Mauritanian Ministry as its advanced datasets make the region attractive for exploration investment opportunities.

David Hajovsky, executive vice president of Multi-Client at TGS, said, “The Mauritania MegaSurvey delivers strategic regional value for our customers. By integrating with broader West African subsurface frameworks, the survey provides deeper insight into basin architecture and petroleum systems along the Atlantic Margin. This regional perspective enables operators to assess Mauritania in the context of neighboring proven and emerging basins, supporting play fairway analysis and a more robust understanding of cross-border geological trends.”

The Mauritania MegaSurvey further strengthens TGS’ multi-client leadership offshore West Africa and complements the company’s extensive portfolio of 2D seismic, 3D seismic, and well data across the region.

With all reservoir and operations risks for 2026 considered, Tullow Oil is aiming an average production rate of 34-42 kboepd, including 6 kboepd of gas

In 2025, Ntomme and Enyenra performance from TEN led the field's total production count at 16.0 kbopd, while the exit rate from Jubilee stood at 57 kbopd.

The company will be deploying riser system and riser-base gas lift for well production management activities, and waterflood and fluid lift optimisation. These, along with the support of high-uptime FPSO, five planned Jubilee wells (four producers and one water injector) are expected onstream this year. The J75-P, for instance -- where a rig has been active for drilling -- has recorded three good reservoir intervals.

The recently completed J74-P well is already onstream since January, revealing 50 meters of net pay while generating an initial gross production through the wellbore at 13 kbopd.

The well management measures align with findings from 4D seismic and Ocean Bottom Node seismic surveys to leverage significant reservoir information extracted.

Tullow has made a strategic investment to acquire the TEN FPSO as it will simplify operational synergies between the TEN and Jubilee fields, maximising output in the long term with minimal expenses. The company has already secured 10-year and 14-year-long ratifications on the West Cape Three Points and Deep Water Tano Petroleum Agreements.

Ian Perks, chief executive officer, Tullow Oil Plc, said, “2025 has been a year of disciplined execution across the business. This includes strong operational momentum which continues with excellent results from the latest Jubilee well and a further five wells due onstream this year to support our production targets. We have achieved significant cost reductions and completed the sale of non-core assets in our ongoing efforts to streamline our portfolio and strengthen our financial position.

“However our 2025 full year free cashflow was negatively impacted by the commodity price environment towards the end of the year and delays in receipt of Government of Ghana receivables and the second instalment of proceeds from the Kenya disposal.

“The refinancing transaction we have announced today enables us to focus on delivering our near-term priorities, which include driving further cost efficiencies, improving cashflow management and optimising our production."

Equatorial Guinea's national oil company, GEPetrol, has secured a heads of agreement (HoA) with American oil major, Chevron, pushing its stake in Block I's Aseng Gas Project from 5% to a whopping 32.55%

This means a big break for the country, which came following months of negotiation since the Vice President, Teodoro Nguema Obiang Mangue's visit to the United States last year.

The partnership will go a long way in well establishing the country's stronghold on its natural resources, and leveraging Aseng output, as the single field is potential of determining several downstream and upstream developments under the Extended Gas Mega Hub initiative. Alongside big projects like Alen Tail and Yoyo-Yolanda, it also unlocks access for GEPetrol in Chevron-operated blocks and potential cross-border gas flows through Gulf of Guinea pipeline infrastructure.

The agreement further ensures for GEPetrol long-term gas supply to the Punta Europa complex that will help sustain existing LNG and processing infrastructure by improving cost efficiency and reducing stranded gas. As a gas monetisation hub, this will give the Equatorial Guinea an extra edge in the global commodities market, where LNG demand continues to gain prominence.

“This agreement represents a strategic step forward for our energy sector, enhancing national participation and opening the door for further projects that will drive industrial development, create jobs and strengthen energy security for our country and the region,” said Antonio Oburu Ondo, Minister of Hydrocarbons and Mining Development of Equatorial Guinea, following the signing of the agreement at the People’s Palace in Malabo, where senior government officials, Chevron executives and the United States Ambassador were also present.

The collaboration shows Chevron's reliance on Equatorial Guinea's oil and gas industry as well as its willingness for regional integration. The major is ready to support maximum state participation, with a greater emphasis on capacity building, knowledge transfer and local workforce development, to establish mutual opportunities from the country's broader Gas Mega Hub. This also reflects Equatorial Guinea's investors-friendly policies, which are adaptive to flexible financial solutions.

Alongside Aseng-operator, Chevron, and GEPetrol, the project also includes Glencore and Gunvor.

As the Uganda National Oil Company aims to build a crude refinery, it has reached out to a unit of global commodities trader, Vitol, for a US$2bn loan to support the project alongside construction and infrastructure developments

According to Henry Musasizi, Uganda's junior finance minister, this seven-year tenor loan from Vitol Bahrain EC (VBA) comes with an interest rate of 4.92%. The minister worked on advancing the approval process for the credit line and the loan, which involved significant lawmakers, who sanctioned the development with a majority verdict.

Musasizi said that Vitol's support "presents an opportunity to access non-traditional financing to implement. ..projects and support the government in developing national infrastructure."

Vitol Bahrain EC has a long-standing presence in Uganda's downstream sector, functioning as the sole supplier of refined petroleum products to UNOC, before the state-owned company sells it to retailers across the country.

Alongside the refinery, the loan amount will also be covering road construction, a petroleum products storage terminal and extension of a petroleum pipeline from western Kenya to Uganda's capital Kampala.

Previously, the UNOC also concluded a deal with the UAE-based Alpha MBM Investments, whereby a domestic refinery with a capacity of 60,000 barrels per day is in the pipeline. The agreement accords 60% stake on the refinery to the UAE firm while UNOC retains 40%.

Uganda is looking to begin commercial oil generation starting next year from fields in its west.

Oil Review Africa catches up with Christopher Hudson, President of dmg events, ahead of ADIPEC 2025

Excerpts from an interview:

Energy across Africa, as elsewhere in the world, is seeing major shifts and advancements. How does ADIPEC 2025 reflect this changing industry landscape and help meet the needs?

Energy is one of the most dynamic and rapidly evolving sectors. According to the International Energy Agency (IEA), global energy demand rose by 2.2% last year, outpacing the average annual increase of 1.3% recorded over the last decade. At the same time, the global population is projected to reach 9.8 billion by 2050, with over 750 million people still lacking access to electricity, and more than 2.1 billion people remain without access to clean cooking. Rising urbanisation and living standards are reshaping energy demand, with air conditioning alone expected to be one of the largest contributors to electricity demand growth in the coming decades. This reveals the sector’s increasing need to not only produce more energy but to produce it in a way that is equitable and sustainable.

In this context, ADIPEC 2025 is being held under the theme of ‘Energy. Intelligence. Impact’. It reflects a simple but powerful truth: meeting the world’s growing need for secure, affordable and sustainable energy will depend on how intelligently we harness every resource – human, technological and natural – to deliver meaningful results for economies and communities alike.

At its core, the theme recognises that intelligence – both human and artificial – is transforming the way energy is produced, managed, and consumed. From AI-driven optimisation and digital integration to advances in hydrogen, LNG, and decarbonisation, intelligent innovation is reshaping the global energy landscape. ADIPEC serves as the meeting point for these forces, where ideas translate into action and impact can be measured in investment, policy, and progress.

AI is a major topic of discussion in the context of energy, due to its high demand. How is ADIPEC responding to the challenges and opportunities of the AI-energy nexus?

Artificial intelligence is reshaping both global energy demand and the industry’s ability to respond. Data centres already consume around 1.5% of global electricity, and with AI workloads, that demand could more than double by 2030, rising from 415 TWh to 945 TWh. A single advanced AI model can require as much electricity to train as 100 households use in a year, while an AI query may consume 10 times more energy than a standard search.

This convergence is both a challenge and an opportunity. AI requires enormous energy, but it can also optimise grids, cut waste, improve operational efficiency, and accelerate decarbonisation. At ADIPEC 2025, we have expanded our AI Zone into five experiential areas showcasing how AI is transforming systems, people, and infrastructure. Alongside this, more than 80 conference sessions are dedicated to the AI–energy nexus, from predictive analytics to governance frameworks.

For Africa, this is particularly significant. Many countries are rapidly digitalising while also expanding power systems. The ability of AI to enhance reliability and reduce costs could be transformative for energy access and economic growth.

How is the diversity of the African continent and its vast energy sector reflected across ADIPEC 2025’s programme?

Africa is a core part of ADIPEC’s community. This year, we are proud to welcome a strong delegation of African ministers and leaders, including those from Nigeria, Kenya, Uganda, Sierra Leone, Zimbabwe, Gambia, Equatorial Guinea, and Egypt. Their participation enriches ADIPEC’s Strategic Conference and exhibitions, ensuring Africa’s perspectives are reflected in discussions on natural gas, hydrogen, downstream, and low-carbon solutions.

dmg events is also the largest organiser of energy and infrastructure events across Africa, with long-standing operations in Nigeria, Mozambique, Kenya, Ethiopia, Ghana, Tanzania, South Africa, Egypt and Morocco. This presence gives us a unique vantage point to bridge African priorities with global dialogue.

Africa holds some of the world’s largest reserves of natural gas, oil, and minerals, as well as enormous potential in renewables. ADIPEC is committed to supporting this potential by convening African voices alongside global leaders, unlocking partnerships that can expand access, accelerate industrialisation, and strengthen Africa’s contribution to global energy progress.

Some of ADIPEC 2025’s notable African speakers include: Honourable J. Opiyo Wandayi, Cabinet Secretary for Energy and Petroleum, Kenya; Honourable Sen. Dr. Heineken Lokpobiri, Minister for State (Oil), Petroleum Resources, Nigeria; Rt. Honourable Ekperikpe Ekpo, Minister for State (Gas) Petroleum Resources, Nigeria; Honourable Chief Adebayo Adelabu, Minister of Power, Nigeria; Honourable Julius D. Mattai, Minister of Mines and Mineral Resources, Republic of Sierra Leone; Honourable Ruth Nankabirwa Ssentamu, Minister of Energy and Mineral Development, Uganda; His Excellency Karim Badawi, Minister of Petroleum and Mineral Resources, Arab Republic of Egypt; His Excellency Antonio Oburu Ondo, Minister of Mines and Hydrocarbons, Equatorial Guinea, Honorable Julius D. Mattai, Minister of Mines and Mineral Resources, Republic of Sierra Leonne; Honourable July Moyo, Minister of Energy and Power Development, Zimbabwe; His Excellency Nani Juwara, Minister of Petroleum and Energy, Gambia; Honourable Cheikh Niane, Deputy Minister of Petroleum and Energy, Senegal, and Mathias Katamba, board chairman, Uganda National Oil Company.