In The Spotlight

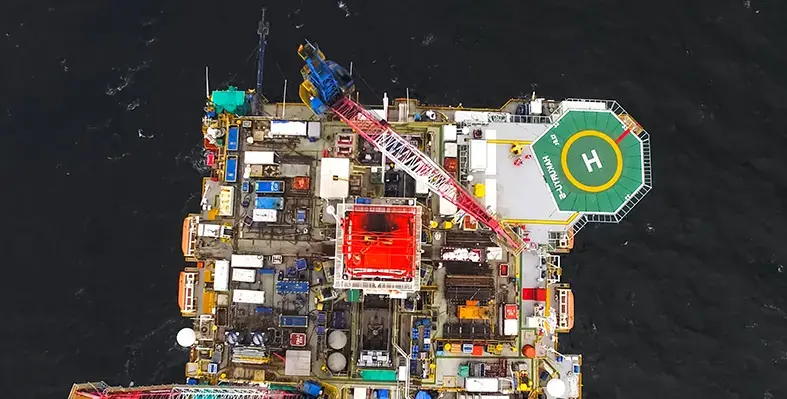

The Eni-led Mozambique Rovuma Venture has signed a significant contract with Technip Energies, JGC and Samsung Heavy Industries to secure their ongoing project delivery services for the long term on the Coral Norte Floating Liquefied Natural Gas project offshore Mozambique

This follows the previously announced contract on initial activities, locking in Technip's services for the advanced stages of development as well.

The country’s second floating LNG facility, Coral Norte will be an enhanced replica of the Coral Sul project, which is currently up and running, producing over 5 million tonnes of LNG. The hull launch of Coral Norte already took place in South Korea in January.

Loic Chapuis, president - project delivery and services of Technip Energies, said, "Building on the success of Coral Sul, and together with JGC and Samsung Heavy Industries, this award further strengthens our long-standing partnership with Eni and their Area 4 partners. It also underscores our leadership in delivering innovative and complex LNG solutions to support long-term energy supply and security in Mozambique and globally.”

Replicating the same feed gas composition and field location of the Coral Sul will ensure a cost-effective and de-risked project delivery for Coral Norte, as it will be the result of proven design. This predictability at scale will ensure boosted LNG output from Coral Norte with optimal investments.

“Coral Norte is a clear recognition of Technip Energies’ engineering and project delivery expertise and our ability to replicate proven solutions with discipline and certainty," Chapuis said.

Corcel Plc has reported excellent data quality from initial internal review following the acquisition of 2D seismic at the operated KON-16 Block, within the Kwanza Basin onshore Angola

"The project was executed without incident, to a very high standard, and the initial results are incredibly encouraging," said Richard Lane, Corcel's chief operating officer while calling the programme a "milestone" as it came as part of the company's fist operated exploration and production project.

Delivered on schedule, the 326-line kms of high resolution 2D seismic data provided clear imaging of key pre‑salt structures, implying an opportunity to de-risk several pre-salt and post-salt zones before initiating drilling within KON-16. Prospect maturation and drilling preparation will be determined by results from the year-long seismic processing that has been specifically designed with the region's high-graded pre salt indications in mind.

Corcel's aim to crack KON-16's complex pre-salt plays is exactly where DUG Technology's imaging expertise lies in. The geophysical processing specialist will be undertaking the project, ensuring the KON‑16 dataset is processed to the highest technical standard.

The acquisition programme was largely supported by BGP INC, China National Petroleum Corporation and its local subsidiary.

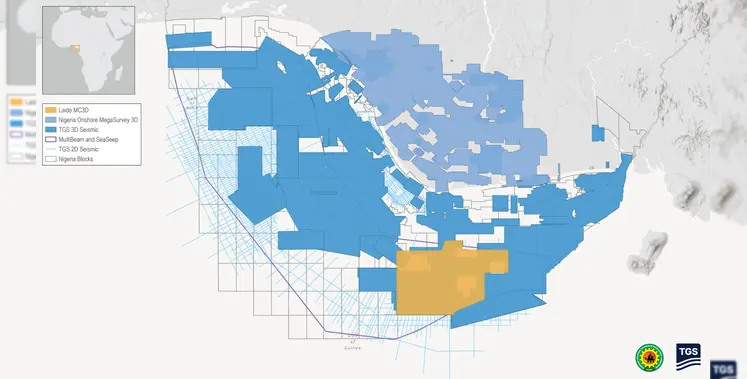

Nigerian exploration and production company, Seplat Energy, has recorded substantial results for 2025 driven largely by output from newly acquired offshore assets as well as by building on its already well established onshore portfolio

"In 2025 we clearly illustrated our ability to operate at scale. We benefitted from successful execution of several key offshore activities that kick-started life for Seplat as an offshore operator, while at the same time delivering onshore production performance that was the strongest in recent memory," said Roger Brown, chief executive officer, Seplat, which recorded 14% year-on-year production delivery onshore.

The last year will remain big for Seplat also in terms of gas generation as it completed the Sapele Gas Plant, and the ANOH gas plant which was up and running to generate gas starting January 2026. Production from ANOH is stable at 50-70 mn standard cu/ft per day, with ~60kbbl condensate currently in storage.

"In recent weeks we were delighted to achieve first gas at the ANOH Gas Plant and are on track to doubling Joint Venture gas volumes at Oso-BRT to 240 mn standard cu/ft per day in the second half of 2026," said Brown while mentioning the company's aim to achieve working interest production to 200 kboepd by 2030.

In 2025, Seplat's group production averaged 131,506 boepd, up 148% from 2024 (52,947 boepd) on the back of offshore consolidation. The Yoho platform outage, however, limited growth rate at 9% year on year on a pro-forma basis. The company plans to restart it in 2Q 2026.

Natural gas liquids recovery from the company's first major offshore project, EAP IGE, peaked at approximately 20 kboepd in 2025. Idle well restoration programme was a success beyond expectations as it added 48.6 kboepd gross production capacity from 49 wells.

"Drilling will be a decisive factor in meeting our long-term growth ambitions and I am pleased to announce that the first jack-up drilling rig is contracted, in country and set to arrive at Oso in 3Q to commence a multi-year, multi-well drilling campaign," said Brown.

Nigerian exploration and production company, Seplat Energy, has recorded substantial results for 2025 driven largely by output from newly acquired offshore assets as well as by building on its already well established onshore portfolio

"In 2025 we clearly illustrated our ability to operate at scale. We benefitted from successful execution of several key offshore activities that kick-started life for Seplat as an offshore operator, while at the same time delivering onshore production performance that was the strongest in recent memory," said Roger Brown, chief executive officer, Seplat, which recorded 14% year-on-year production delivery onshore.

The last year will remain big for Seplat also in terms of gas generation as it completed the Sapele Gas Plant, and the ANOH gas plant which was up and running to generate gas starting January 2026. Production from ANOH is stable at 50-70 mn standard cu/ft per day, with ~60kbbl condensate currently in storage.

"In recent weeks we were delighted to achieve first gas at the ANOH Gas Plant and are on track to doubling Joint Venture gas volumes at Oso-BRT to 240 mn standard cu/ft per day in the second half of 2026," said Brown while mentioning the company's aim to achieve working interest production to 200 kboepd by 2030.

In 2025, Seplat's group production averaged 131,506 boepd, up 148% from 2024 (52,947 boepd) on the back of offshore consolidation. The Yoho platform outage, however, limited growth rate at 9% year on year on a pro-forma basis. The company plans to restart it in 2Q 2026.

Natural gas liquids recovery from the company's first major offshore project, EAP IGE, peaked at approximately 20 kboepd in 2025. Idle well restoration programme was a success beyond expectations as it added 48.6 kboepd gross production capacity from 49 wells.

"Drilling will be a decisive factor in meeting our long-term growth ambitions and I am pleased to announce that the first jack-up drilling rig is contracted, in country and set to arrive at Oso in 3Q to commence a multi-year, multi-well drilling campaign," said Brown.

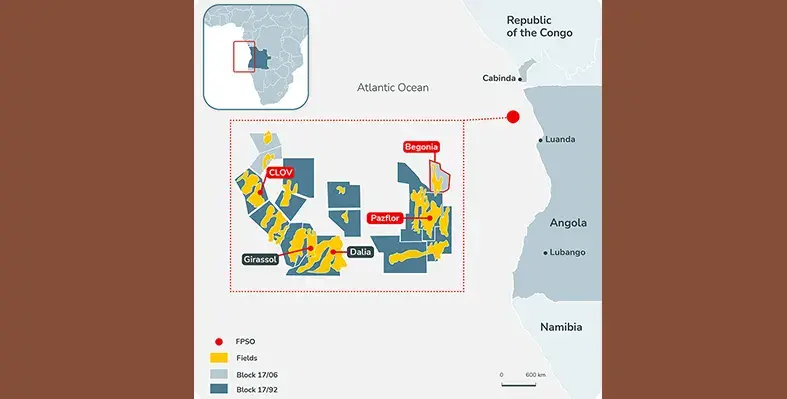

Energy data and intelligence provider, TGS, has announced the Ultra Profundo multi-client 2D survey offshore Angola

The survey spans approximately 12,600 line kilometers, and Ramform Victory began operations earlier in Q1. Data acquisition is likely to be completed in around 100 days, with fast-track products available in Q3. Full data processing is scheduled for completion in Q2 2027.

The Ultra Profundo multi-client 2D survey marks the first 2D multi-client acquisition over Angola’s ultra deep-water areas since 2015 and aims to reach previously underexplored region. The survey delivers modern, long-offset seismic data critical for imaging complex pre-salt and top-salt structures as well as basin floor channel systems, significantly enhancing regional geological understanding.

Kristian Johansen, CEO of TGS, said, “Angola’s ultra deep-water margin represents one of the most exciting frontier exploration opportunities in West Africa. Our Ultra Profundo multi-client 2D program delivers high-quality seismic coverage needed to unlock pre-salt and sub-salt potential. By leveraging TGS’ acquisition and imaging capabilities, we will provide high-quality data supporting future exploration activities.”

With all reservoir and operations risks for 2026 considered, Tullow Oil is aiming an average production rate of 34-42 kboepd, including 6 kboepd of gas

In 2025, Ntomme and Enyenra performance from TEN led the field's total production count at 16.0 kbopd, while the exit rate from Jubilee stood at 57 kbopd.

The company will be deploying riser system and riser-base gas lift for well production management activities, and waterflood and fluid lift optimisation. These, along with the support of high-uptime FPSO, five planned Jubilee wells (four producers and one water injector) are expected onstream this year. The J75-P, for instance -- where a rig has been active for drilling -- has recorded three good reservoir intervals.

The recently completed J74-P well is already onstream since January, revealing 50 meters of net pay while generating an initial gross production through the wellbore at 13 kbopd.

The well management measures align with findings from 4D seismic and Ocean Bottom Node seismic surveys to leverage significant reservoir information extracted.

Tullow has made a strategic investment to acquire the TEN FPSO as it will simplify operational synergies between the TEN and Jubilee fields, maximising output in the long term with minimal expenses. The company has already secured 10-year and 14-year-long ratifications on the West Cape Three Points and Deep Water Tano Petroleum Agreements.

Ian Perks, chief executive officer, Tullow Oil Plc, said, “2025 has been a year of disciplined execution across the business. This includes strong operational momentum which continues with excellent results from the latest Jubilee well and a further five wells due onstream this year to support our production targets. We have achieved significant cost reductions and completed the sale of non-core assets in our ongoing efforts to streamline our portfolio and strengthen our financial position.

“However our 2025 full year free cashflow was negatively impacted by the commodity price environment towards the end of the year and delays in receipt of Government of Ghana receivables and the second instalment of proceeds from the Kenya disposal.

“The refinancing transaction we have announced today enables us to focus on delivering our near-term priorities, which include driving further cost efficiencies, improving cashflow management and optimising our production."

Equatorial Guinea's national oil company, GEPetrol, has secured a heads of agreement (HoA) with American oil major, Chevron, pushing its stake in Block I's Aseng Gas Project from 5% to a whopping 32.55%

This means a big break for the country, which came following months of negotiation since the Vice President, Teodoro Nguema Obiang Mangue's visit to the United States last year.

The partnership will go a long way in well establishing the country's stronghold on its natural resources, and leveraging Aseng output, as the single field is potential of determining several downstream and upstream developments under the Extended Gas Mega Hub initiative. Alongside big projects like Alen Tail and Yoyo-Yolanda, it also unlocks access for GEPetrol in Chevron-operated blocks and potential cross-border gas flows through Gulf of Guinea pipeline infrastructure.

The agreement further ensures for GEPetrol long-term gas supply to the Punta Europa complex that will help sustain existing LNG and processing infrastructure by improving cost efficiency and reducing stranded gas. As a gas monetisation hub, this will give the Equatorial Guinea an extra edge in the global commodities market, where LNG demand continues to gain prominence.

“This agreement represents a strategic step forward for our energy sector, enhancing national participation and opening the door for further projects that will drive industrial development, create jobs and strengthen energy security for our country and the region,” said Antonio Oburu Ondo, Minister of Hydrocarbons and Mining Development of Equatorial Guinea, following the signing of the agreement at the People’s Palace in Malabo, where senior government officials, Chevron executives and the United States Ambassador were also present.

The collaboration shows Chevron's reliance on Equatorial Guinea's oil and gas industry as well as its willingness for regional integration. The major is ready to support maximum state participation, with a greater emphasis on capacity building, knowledge transfer and local workforce development, to establish mutual opportunities from the country's broader Gas Mega Hub. This also reflects Equatorial Guinea's investors-friendly policies, which are adaptive to flexible financial solutions.

Alongside Aseng-operator, Chevron, and GEPetrol, the project also includes Glencore and Gunvor.

As the Uganda National Oil Company aims to build a crude refinery, it has reached out to a unit of global commodities trader, Vitol, for a US$2bn loan to support the project alongside construction and infrastructure developments

According to Henry Musasizi, Uganda's junior finance minister, this seven-year tenor loan from Vitol Bahrain EC (VBA) comes with an interest rate of 4.92%. The minister worked on advancing the approval process for the credit line and the loan, which involved significant lawmakers, who sanctioned the development with a majority verdict.

Musasizi said that Vitol's support "presents an opportunity to access non-traditional financing to implement. ..projects and support the government in developing national infrastructure."

Vitol Bahrain EC has a long-standing presence in Uganda's downstream sector, functioning as the sole supplier of refined petroleum products to UNOC, before the state-owned company sells it to retailers across the country.

Alongside the refinery, the loan amount will also be covering road construction, a petroleum products storage terminal and extension of a petroleum pipeline from western Kenya to Uganda's capital Kampala.

Previously, the UNOC also concluded a deal with the UAE-based Alpha MBM Investments, whereby a domestic refinery with a capacity of 60,000 barrels per day is in the pipeline. The agreement accords 60% stake on the refinery to the UAE firm while UNOC retains 40%.

Uganda is looking to begin commercial oil generation starting next year from fields in its west.

Oil Review Africa catches up with Christopher Hudson, President of dmg events, ahead of ADIPEC 2025

Excerpts from an interview:

Energy across Africa, as elsewhere in the world, is seeing major shifts and advancements. How does ADIPEC 2025 reflect this changing industry landscape and help meet the needs?

Energy is one of the most dynamic and rapidly evolving sectors. According to the International Energy Agency (IEA), global energy demand rose by 2.2% last year, outpacing the average annual increase of 1.3% recorded over the last decade. At the same time, the global population is projected to reach 9.8 billion by 2050, with over 750 million people still lacking access to electricity, and more than 2.1 billion people remain without access to clean cooking. Rising urbanisation and living standards are reshaping energy demand, with air conditioning alone expected to be one of the largest contributors to electricity demand growth in the coming decades. This reveals the sector’s increasing need to not only produce more energy but to produce it in a way that is equitable and sustainable.

In this context, ADIPEC 2025 is being held under the theme of ‘Energy. Intelligence. Impact’. It reflects a simple but powerful truth: meeting the world’s growing need for secure, affordable and sustainable energy will depend on how intelligently we harness every resource – human, technological and natural – to deliver meaningful results for economies and communities alike.

At its core, the theme recognises that intelligence – both human and artificial – is transforming the way energy is produced, managed, and consumed. From AI-driven optimisation and digital integration to advances in hydrogen, LNG, and decarbonisation, intelligent innovation is reshaping the global energy landscape. ADIPEC serves as the meeting point for these forces, where ideas translate into action and impact can be measured in investment, policy, and progress.

AI is a major topic of discussion in the context of energy, due to its high demand. How is ADIPEC responding to the challenges and opportunities of the AI-energy nexus?

Artificial intelligence is reshaping both global energy demand and the industry’s ability to respond. Data centres already consume around 1.5% of global electricity, and with AI workloads, that demand could more than double by 2030, rising from 415 TWh to 945 TWh. A single advanced AI model can require as much electricity to train as 100 households use in a year, while an AI query may consume 10 times more energy than a standard search.

This convergence is both a challenge and an opportunity. AI requires enormous energy, but it can also optimise grids, cut waste, improve operational efficiency, and accelerate decarbonisation. At ADIPEC 2025, we have expanded our AI Zone into five experiential areas showcasing how AI is transforming systems, people, and infrastructure. Alongside this, more than 80 conference sessions are dedicated to the AI–energy nexus, from predictive analytics to governance frameworks.

For Africa, this is particularly significant. Many countries are rapidly digitalising while also expanding power systems. The ability of AI to enhance reliability and reduce costs could be transformative for energy access and economic growth.

How is the diversity of the African continent and its vast energy sector reflected across ADIPEC 2025’s programme?

Africa is a core part of ADIPEC’s community. This year, we are proud to welcome a strong delegation of African ministers and leaders, including those from Nigeria, Kenya, Uganda, Sierra Leone, Zimbabwe, Gambia, Equatorial Guinea, and Egypt. Their participation enriches ADIPEC’s Strategic Conference and exhibitions, ensuring Africa’s perspectives are reflected in discussions on natural gas, hydrogen, downstream, and low-carbon solutions.

dmg events is also the largest organiser of energy and infrastructure events across Africa, with long-standing operations in Nigeria, Mozambique, Kenya, Ethiopia, Ghana, Tanzania, South Africa, Egypt and Morocco. This presence gives us a unique vantage point to bridge African priorities with global dialogue.

Africa holds some of the world’s largest reserves of natural gas, oil, and minerals, as well as enormous potential in renewables. ADIPEC is committed to supporting this potential by convening African voices alongside global leaders, unlocking partnerships that can expand access, accelerate industrialisation, and strengthen Africa’s contribution to global energy progress.

Some of ADIPEC 2025’s notable African speakers include: Honourable J. Opiyo Wandayi, Cabinet Secretary for Energy and Petroleum, Kenya; Honourable Sen. Dr. Heineken Lokpobiri, Minister for State (Oil), Petroleum Resources, Nigeria; Rt. Honourable Ekperikpe Ekpo, Minister for State (Gas) Petroleum Resources, Nigeria; Honourable Chief Adebayo Adelabu, Minister of Power, Nigeria; Honourable Julius D. Mattai, Minister of Mines and Mineral Resources, Republic of Sierra Leone; Honourable Ruth Nankabirwa Ssentamu, Minister of Energy and Mineral Development, Uganda; His Excellency Karim Badawi, Minister of Petroleum and Mineral Resources, Arab Republic of Egypt; His Excellency Antonio Oburu Ondo, Minister of Mines and Hydrocarbons, Equatorial Guinea, Honorable Julius D. Mattai, Minister of Mines and Mineral Resources, Republic of Sierra Leonne; Honourable July Moyo, Minister of Energy and Power Development, Zimbabwe; His Excellency Nani Juwara, Minister of Petroleum and Energy, Gambia; Honourable Cheikh Niane, Deputy Minister of Petroleum and Energy, Senegal, and Mathias Katamba, board chairman, Uganda National Oil Company.