In The Spotlight

Europa Oil & Gas' associated company, Antler Global Limited, will be farming out an interest in the EG08 production sharing contract (PSC) offshore Equatorial Guinea by a non-binding Heads of Terms with a major energy company

Both partners have entered into detailed commercial discussions to advance the farm out agreement, which will become official once approved by the Minister for Energy of Equatorial Guinea.

Europa has a 42.9% equity interest in Antler which in turn holds an 80% working interest in the EG-08 PSC, with the remaining 20% held by GEPetrol (Guinea Equatorial de Petroleos), the national oil company of Equatorial Guinea, representing the State’s interest.

The EG-08 block contains 2.116 TCF (Pmean), with the primary prospect being Barracuda which is estimated to be 798 BCF (Pmean).

William Holland, chief executive officer of Europa, said, “The signing of these heads of terms is a very positive step forward and comes after an extensive period of negotiations with what we believe is an excellent partner. Although there are no guarantees, I am confident that we will progress to signing a farm out agreement in the coming months and will then move to drilling the Barracuda well as soon as possible thereafter. I look forward to updating the market of our progress in due course.”

As drilling begins in the Kavango West 1X exploration well, Reconnaissance Energy Africa reports that this development was a reprioritisation following the Naingopo drilling

Spud on July, the Kavango West 1X exploration prospect will be drilled to reach total depth of approximately 3,800 m by the end of November 2025. It will penetrate over 1,500 m of Otavi carbonate reservoir section, which is the primary target of the Damara Fold Belt play. Modern 2D seismic data shows the prospect as a large structural fold, extending over 22 kms long by 3 kms wide. The Damara Fold Belt trend has projected 19 prospects and four leads, with an additional 5.0 mn acres captured in a recently executed memorandum of understanding in offsetting Angola.

Brian Reinsborough, president and CEO, said, “We are pleased to announce that we have started drilling the Kavango West 1X well. This is an exciting time for everyone at the company, our partners and stakeholders in Namibia and, of course, shareholders alike. Originally, the Kavango West 1X location was not scheduled to be the next well, but the location was reprioritised after the results of our last well, Naingopo. While this reprioritising resulted in a slightly longer lead time to spud this location, the company prioritises rigorous technical appraisal with respect to location selection to ensure we have the best possible chance for commercial success. We think that the Kavango West 1X prospect represents our best opportunity in the Damara Fold Belt to unlock the potential of this play and we look forward to reporting results expected before year-end 2025.”

Chris Sembritzky, senior vice president-exploration, said, “By utilising our learnings from the Naingopo well, Kavango West 1X represents the best opportunity we have identified on seismic in the Damara Fold Belt play due to its size, hydrocarbon migration pathway and well defined four-way closure. With our new subsurface learnings, highly experienced drilling crew and optimised, built for purpose drill bits, we believe that we have captured the best possible chance for drilling an efficient, safe and commercially successful well.”

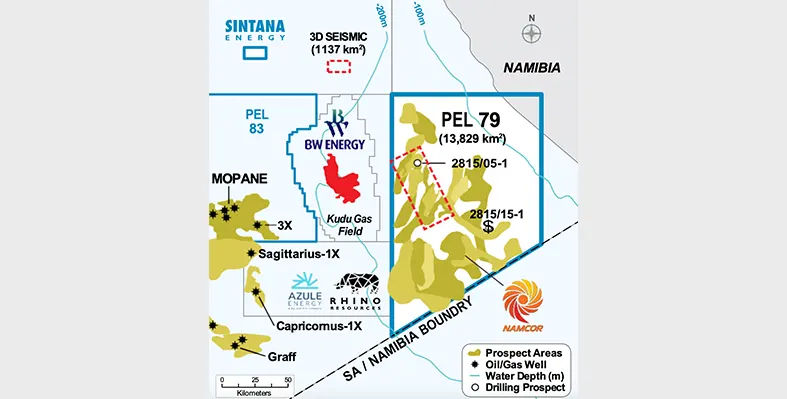

BW Energy has recorded solid operational performance in the first half of 2025

This was the result of high production uptime, competitive cost levels, and a solid safety record with zero lost time incidents. The year's highlights are when the company reached final investment decisions on both the Maromba development and the Golfinho Boost project. Also, the company expanded its resource base as it made a significant discovery of 25 million barrels of oil at the Bourdon prospect in the Dussafu area. It has acquired operatorship of the BW Adolo FPSO as well.

These developments have enabled strong cash generation and a resilient financial structure for the company.

Carl Arnet, CEO of BW Energy, said, “BW Energy delivered a strong first half of 2025, with production above the upper end of our guidance range and operating costs at significantly more competitive levels than in 2024. This reflects continued focus on safe, efficient operations and disciplined cost management across the portfolio.

"During the period, we moved key development projects into execution, marking an important step forward in our growth strategy. The Maromba development in Brazil is now underway and will be transformative for BW Energy, increasing production to more than 90,000 barrels per day in 2028.

"Furthermore, we strengthened our portfolio, confirming new resources at the Bourdon prospect in the Dussafu licence. These are highly profitable barrels that highlight our strategy of leveraging existing infrastructure and pursuing fast‑track developments to accelerate value creation.

"Our financial foundation remains robust, with low leverage and strong underlying cash generation. This gives us the resilience to navigate market volatility while continuing to deliver growth and long‑term value for our shareholders.”

Kingdom of Bahrain

A MoU was signed between the Ministry of Petroleum and Mineral Resources and UEG. (Image source: Ministry of Petroleum and Mineral Resources)

While paying an official visit to the United Arab Emirates, Karim Badawi, Minister of Petroleum and Mineral Resources, held a meeting with Song Yu, chairman and executive director, Kamel El-Sawi, the company's Regional President for Africa, and the accompanying delegation

UEG's investment expansion interests in Egypt and its strategic partnership with the Egyptian petroleum sector in Iraq were acknowledged during the meeting.

A memorandum of understanding (MoU) was signed between the Ministry of Petroleum and Mineral Resources and UEG to establish a strategic framework for cooperation in exploring investment opportunities in the oil and gas sectors inside and outside Egypt, while exploring the possibility of expanding renewable energy projects and energy trading activities.

Following the signing, Song Yu appreciated the fruitful cooperation with the Egypt's petroleum sector, highlighting that the successes achieved on the ground reinforce the company's desire to continue expanding the partnership, especially in light of the strategic pillars and efforts by the Ministry of Petroleum, under the leadership of the Minister of Petroleum, to attract investment and develop the sector.

A single well location can now be pinpointed at Oryx prospect. (Image source: Pancontinental Energy)

Pancontinental Energy has released revised estimates of prospective resources for the company's PEL 87 project, Orange Basin offshore Namibia

Pancontinental chief executive officer, Iain Smith, said, "The Pancontinental technical team continues to deliver, such that we are now able to pinpoint a single well location at the Oryx prospect that offers oil potential at three discrete intervals for a combined 2.5 billion barrels of High Case prospective resource, with a Geological Chance of Success upgraded to 26.2%."

The Oryx prospect now incorporates the prospective features previously identified as the Calypso and Addax Channel leads, due to the fact that it has been determined that all three targets may be effectively tested by a single exploration well. As a result the High Case (3U) prospective resource estimate (gross, 100%) for Oryx now stands at over 2.5bn barrels of oil, recoverable.

Of note is that, in general terms, it is the Best Case (2U) prospective resource estimates which have most benefited from the revised inputs, in particular for Oryx and Hyrax (due to their relative maturity, as prospects). The Low Case (1U) and High Case (3U) for each prospect/lead is affected to a lesser degree and the prospective resource estimates for the Addax Fan and Addax South leads remain unchanged, as does the GCoS. The GCoS for the remainder of the prospect/lead inventory has increased, based upon seismic synthetic modelling which provides positive indications for a hydrocarbon fluid effect (interpreted as a low gas-oil-ratio oil). As such the estimated GCoS for the main Oryx prospect now stands at 26.2% (previous estimate 22.5%).

QI screening is currently on, generating a mapping of an additional prospective feature, external to the Saturn Complex. The Phoebe West lead is interpreted as an Albian-to-Aptian basinal turbidite fan feature fed by a long-lived northern channel clastic bypass depositional system. Interpretation of this feature is ongoing at this time and Pancontinental anticipates providing further detail soon.

Aquaterra Energy has been awarded a two-year contract extension for its offshore analysis services for a major Egyptian operator

This extension comes following the original contract award in 2023, by which the company has delivered detailed riser and subsea well/conductor analysis services in support of operations on seven separate well locations to date.

Over the past two years, bespoke offshore analysis has been provided to validate the performance of new producing subsea wells, drilled from a semi-submersible rig. its services included managing conductor strength requirements during a vessel drift/drive off scenario. The analyses have driven optimisations to casing grade and joint space-outs, whilst collaborating with rig and risk assessment teams to better define and comply with operating guidelines. These critical services ensure that the client’s assets meet operational requirements for their full lifetimes, whilst complying with challenging technical standards and guidelines.

Martin Harrop, offshore analysis manager at Aquaterra Energy, said, “This extension marks an important continuation of our relationship with one of the region’s key operators. Working together over the past two years, we’ve delivered targeted analysis to support safe and efficient well operations in a technically complex environment. We’re looking forward to building on this collaboration and continuing to provide high-integrity, practical analysis that supports operational success offshore Egypt.”

The Agogo FPSO has generated first oil for the National Agency for Petroleum, Gas and Biofuels (ANPG) and Azule Energy, actualising the much anticipated Agogo Integrated West Hub project offshore Angola

This comes in less than three years since the Agogo IWH project began in February 2023, with a phased development approach. It involved appraising-driven process, de-risking the full field exploitation. With a well-coordinated effort to simultaneously manage activities across reservoir, engineering and procurement, the deepwater project is said to have been achieved in record time.

The Agogo project involves the development of two fields, Agogo and Ndungu, in the West Hub of Block 15/06. The Agogo IWH project operated by Azule Energy in Block 15/06, with a 36.84% stake alongside partners Sonangol E&P (36.84%) and Sinopec International (26.32%), is set to add substantial production to Angola's energy landscape. Together, the two fields have estimated reserves of approximately 450 million barrels, with projected peak production of 175,000 barrels per day, produced via two FPSOs (Agogo and Ngoma).

An ode to technological innovation and lower-emissions future, all topsides and marine systems of the Agogo FPSO are designed to be fully electric. Touted as a 'green' FPSO, it features a pilot carbon capture and utilisation/storage (CCUS) unit to recover remaining CO2 volumes. Additionally, the FPSO benefits from combined cycle power generation.

"This new milestone that we have recorded in the Agogo Project reinforces our certainty that we have made the right investment in technological innovation and the valourisation of Angola's natural resources, in an industry where it is essential to combine sustainability, efficiency and inclusion procedures. It is worth highlighting that this is an FPSO prepared to reduce carbon emissions, aligning with energy transition objectives. Furthermore, it demonstrates a strong investment in national human capital, with 80% of the workforce comprised of Angolans,' said the chairman of the Board of Directors of ANPG, Paulino Jerónimo.

"The startup of the Agogo IWH project, sanctioned just months after Azule Energy's formation, represents a defining moment for our company," said Adriano Mongini, CEO of Azule Energy. "It demonstrates not only our technical capabilities but also our firm commitment to supporting Angola's energy landscape. This achievement advances our production goals whilst showcasing our dedication to responsible energy practices through pioneering emission reduction initiatives. We are immensely proud to contribute to Angola's energy future and to set new standards for environmental responsibility in offshore operations."

Mozambique’s state-owned oil company, Petromoc, has entered a strategic deal with a Nigerian energy firm called Aiteo to develop an oil refinery with a capacity to reach 240,000 barrels-per-day

The agreement is a two-way blessing as it not only attracts foreign investments for Mozambique in strategic sectors, but also pushes Aiteo to a further influential position as a local company beyond its Nigerian base.

Signed during a formal ceremony chaired by the Mozambican President Daniel Chapo, the agreement will advance energy independence for the country. It will boost fuel supply security, facilitating the construction of one of the largest refineries in southern Africa, and the Southern African Development Community (SADC).

The engineering procurement and construction activities for the refinery will be covered by an American firm called Deerfield Energy Services LLC. The refinery will be developed in a phased manner with an initial aim to install an 80,000 bpd processing unit within a two-year time frame, and gradually scaled up to the maximum capacity.

While the project promises several benefits, the financial, environmental compliance and execution timelines-based risks involved needs consideration. When ready for operation, the plant will be able to produce petrol, diesel, jet fuel and naptha for domestic as well as regional use.

Calling the project a 'milestone' for its employment generation possibilities, Ransome Owan, Aiteo's group managing director for infrastructure, said, “It will reduce import reliance, create jobs, and lay the foundation for Mozambique to become a leading hub in the region’s downstream energy sector.”

Mozambique is committed to an extensive industrial strategy to advance energy access, economic diversification, and infrastructure development. The refinery falls in line with this strategy as it will ensure greater access to cleaner fuels and advance clean cooking initiatives with the easy availability of liquefied petroleum gas (LPG) distribution.

As Africa is zooming in on brownfield sites for maximum oil recovery, artificial intelligence and machine learning technologies are fuelling the industry's optimisation goals

Redifining operational efficiency by extending field life and maximising output, AI is set to move the oil and gas industry at a US$6.4bn market value by 2030.

As major operators increasingly adopt AI, global oilfield technology companies like Baker Hughes, Halliburton or SLB have opened bases in Africa. SLB's technology is backing several billion-dollar oil projects in Angola, and has introduced the Africa Performance Centre in Luanda this year. It has a strong presence in other regions of Africa as well.

Repsol has several developments underway in Libya, Algeria and Morocco and strives to bolster production across these markets.

Enhanced oil recovery is currently witnessing a disruption as AI has unlocked access to large datasets which is unimaginable with traditional systems. This makes a huge difference for operators in taking the right decisions. With deep geological and production data in hand, reservoir management and pattern identification become much simpler.

AI is now way past the experimental stage, and is being adopted on a policy level as well. Many African countries are streamlining policy to support EOR at legacy assets. Angola, for example, implemented its Incremental Production Initiative in 2024 which offers tax incentives to encourage reinvestments in mature oilfields. Energy major ExxonMobil made the first discovery – the Likembe-01 well - as part of the initiative in 2024, demonstrating the role policy plays in unlocking incremental resources. The African Union Commission also declared AI as a strategic priority for the continent in May 2025, citing the role machine-learning plays in transforming the continent’s development trajectory.

These topics will drive conversations at the African Energy Week (AEW): Invest in African Energies 2025 that will be taking place from 29 September 29 to 3 October in Cape Town.