In The Spotlight

BW Energy Gabon SA has taken over the operation and maintenance work of the FPSO BW Adolo from the principal companies, BW Offshore and BW Energy

An amended charter now includes a mutual put-and-call option on the FPSO for US$100mn, exercisable in 2028.

“Transferring daily operational control of BW Adolo to BW Energy Gabon is a natural step given their growing presence in Gabon and potential to capture efficiencies across the local organisation,” said Marco Beenen, the CEO of BW Offshore. “The seamless execution reflects the commitment of both teams to safeguard personnel, the environment, and asset integrity.”

“Assuming full O&M responsibility will allow BW Energy Gabon to optimise field performance and capture additional synergies across the Dussafu hub. We thank BW Offshore for its exemplary stewardship of the vessel and its continued support during the transition phase,” said Carl K Arnet, the CEO of BW Energy.

The FPSO unit is currently deployed on the Dussafu Marin licence offshore Gabon, where it has produced since first oil in 2018.

Geo Exploration anticipates an yield of approximately 4.31 billion barrels from PEL94. (Image source: Adobe Stock)

With two new sandstone leads identified from petroleum exploration licence (PEL) 94 in Block 2011A offshore Namibia following an independent geoscience evaluation, Geo Exploration Limited has confirmed a materially de‑risked resource base

The sandstone leads are Emerald (in the Albian) and Beryl (in the Cenomanian), which has a combined value of 792 MMbbl of unrisked gross mean prospective resources, with 726 MMbbl attributable to Emerald and 66 MMbbl to Beryl.

Geo Exploration, which holds a 78% working interest in PEL94, is anticipating an yield of approximately 4.31 billion barrels.

Seismic mapping has delineated robust, dip and fault‑bounded structural closures. The seismic data interpretation has also highlighted direct hydrocarbon indicators in the area—including gas

chimneys and flat spots—providing strong evidence for an active petroleum system, migration of hydrocarbons throughout the section and therefore increasing the chance that the leads are charged with oil. The water depth is c.750 m at the location of the leads identified.

The promising seismic results have encouraged the company to move ahead with potential farm-out agreements.

Omar Ahmad, chief executive officer of Geo Exploration, said, "Before commenting on these exciting results, I would first like to congratulate Her Excellency Dr Netumbo Nandi-Ndaitwah on her appointment as President of Namibia and Victoria Sibeya on her appointment as Acting Managing Director of the National Petroleum Corporation of Namibia (NAMCOR). I would like to thank Petroleum Commissioner Maggy Shino, the Namibia Ministry of Mines and Energy and our partners for their continued support to Geo.

Today's resource upgrade underscores the tremendous potential we see in PEL 94 and the strong conviction we have in our Namibian licence. Our technical team has done a terrific job delivering

new, material leads on the eastern side of the block. With excitement building across Namibia—and particularly in the Walvis Basin—we are actively progressing farm-out discussions to secure the best outcome for our shareholders"

Congo's national oil company, Societe Nationale des Petroles du Congo (SNPC), gains a solid ground as two significant laws supporting the country's hydrocarbons industry receive approval of the Council of Ministers

The first law now recognises SNPC as the owner of the new Likouala II exploration permit, following Perenco and Congorep's (a joint venture between Perenco and SNPC) handover of shares. With the new structure, Perenco's shares stand at 64.5%, Congorep at 20.5%, and SNPC at 15%.

The second law allows the Ikalou II permit that comes from the Ikalou Sud concession. With this permit that is valid for 20 years, SNPC retains a 15% stake following Perenco's 85%.

Also read:

Congo oil and gas sector is thriving

Mozambique Gas & Energy Summit & Exhibition

Dates: 25-27 February 2025

Venue: Joaquim Chissano International Conference Centre, Maputo

The equipment will enhance the availability and reliability of power supply. (Image source: Wartsila)

Technology group Wartsila has concluded an engineering, procurement, and construction (EPC), along with a five-year-long operation and maintenance (O&M) agreement with Elektron Energy-affiliate Victoria Island Power Ltd for the installation of a power generation equipment for a new 30 MW power plant being set up on Victoria Island in Lagos

The equipment will enhance the availability and reliability of power supply from the natural gas-run power plant.

“Elektron has conceptualised, developed, and funded the IPP and has secured the implementation by engaging Wartsila to assume single point responsibility for the major construction and operational aspects related to the eventual power generation facility. This pioneering project relies on reciprocating internal combustion engine (RICE) technology that has the efficiency and flexibility to deliver clean and reliable electricity to our customers,” said Deen Solebo, co-CEO and CFO at Elektron Energy.

“ Wartsila’s core competence in the engine power plant and services aspects represents a unique combination of a global company with a local presence that provides developers and financiers the comfort to invest and gives end-customers the confidence to sign up for PPA’s with medium to long-term tenures. The Wartsila solution is extensively adopted by industrial, utility and IPP customers worldwide and the excellent credentials and track record have been recognised as a great value proposition by lenders, insurance companies, and multi-lateral funding institutions,” said Marc Thiriet, energy business director, Africa at Wartsila Energy.

“Elektron is especially grateful to the invaluable contributions of its institutional investors and funding partners who have made this project possible including ARM Harith Infrastructure Fund LP, Nigerian Sovereign Investment Authority, InfraCredit, Bank of Industry, FBN Quest, and Stanbic Infrastructure Partners,” Deen added.

The facility will comprise three Wartsila 34SG gas engine-generator sets with related auxiliaries and is configured to accommodate an extension with one additional engine-generator set at a later stage. The Wärtsilä modular power plant design concept enables this in a cost-effective manner with minimal disruption to ongoing operations.

Geo Exploration anticipates an yield of approximately 4.31 billion barrels from PEL94. (Image source: Adobe Stock)

With two new sandstone leads identified from petroleum exploration licence (PEL) 94 in Block 2011A offshore Namibia following an independent geoscience evaluation, Geo Exploration Limited has confirmed a materially de‑risked resource base

The sandstone leads are Emerald (in the Albian) and Beryl (in the Cenomanian), which has a combined value of 792 MMbbl of unrisked gross mean prospective resources, with 726 MMbbl attributable to Emerald and 66 MMbbl to Beryl.

Geo Exploration, which holds a 78% working interest in PEL94, is anticipating an yield of approximately 4.31 billion barrels.

Seismic mapping has delineated robust, dip and fault‑bounded structural closures. The seismic data interpretation has also highlighted direct hydrocarbon indicators in the area—including gas

chimneys and flat spots—providing strong evidence for an active petroleum system, migration of hydrocarbons throughout the section and therefore increasing the chance that the leads are charged with oil. The water depth is c.750 m at the location of the leads identified.

The promising seismic results have encouraged the company to move ahead with potential farm-out agreements.

Omar Ahmad, chief executive officer of Geo Exploration, said, "Before commenting on these exciting results, I would first like to congratulate Her Excellency Dr Netumbo Nandi-Ndaitwah on her appointment as President of Namibia and Victoria Sibeya on her appointment as Acting Managing Director of the National Petroleum Corporation of Namibia (NAMCOR). I would like to thank Petroleum Commissioner Maggy Shino, the Namibia Ministry of Mines and Energy and our partners for their continued support to Geo.

Today's resource upgrade underscores the tremendous potential we see in PEL 94 and the strong conviction we have in our Namibian licence. Our technical team has done a terrific job delivering

new, material leads on the eastern side of the block. With excitement building across Namibia—and particularly in the Walvis Basin—we are actively progressing farm-out discussions to secure the best outcome for our shareholders"

AIS Bardot will be working for Saipem Group, serving hybrid riser lines to develop Total Energies’ Kaminho project in Angola

The contract outlines manufacture and supply of three complete hybrid riser lines of 100 metres each. These will be used to pump seawater to provide the appropriate volume and flow of cold water to cool down essential equipment and prevent overheating in the FPSO unit.

To ensure they are light and compact, the riser lines will be manufactured with high-density polyethylene instead of traditional rubber and steel. Cheaper operating costs besides, these less-energy consuming risers will also be sustainable to use.

Stanislas Tchoutakian, business development manager for France, said, “This success strengthens our close relationship with Saipem and Total on this very particular supply. Many years of development and qualification led to this award, congratulations to all the team who made this achievement possible.”

Engineered to meet the precise requirements of water depth, temperature, and flow rate, the water intake risers accommodate the hydrodynamic stresses of the operational environment, ensuring maximum functionality and cost effectiveness. They are easy to install, with a long life span and no maintenance required, while meeting international offshore standard to meet all required specifications.

AIS, (incorporating Covertherm, Manuplas, Bardot, and CRP Subsea) supplies insulation, passive fire protection, buoyancy, and cable protection systems.

Advancing the modernisation of its Secunda power plant in Mpumalanga, Sasol has ensured enhanced reliability of power supply to the national grid

The energy and chemical company had employed manufacturing firm, GE Vernova, to replace the existing pre-combustor system with a new DLN1+ combustor supplemented by the Fuel Gas Module (FGM) skid. This gave a boost to operational efficiency of the two installed 9E gas turbines, while also reducing carbon emissions. Each gas turbine has been emitting approximately 10,000 metric tons less CO2 since the replacement.

The new combustor has reduced NOx emissions by three quarters from previous levels.

The DLN technology has markedly reduced water consumption.

The modernised plant requires comparatively lesser maintenance, reducing downtime and operational costs.

"This project exemplifies our purpose to electrify the world," said Joseph Anis, president and CEO of GE Vernova's Gas Power business in Europe, Middle East, and Africa. "Building on our advanced combustion technologies, we are helping Sasol address South Africa’s energy needs more efficiently. Together, we are demonstrating how advanced technologies can deliver tangible benefits for both businesses and communities."

In a major step towards local collaboration, Botswana and Namibia are planning to jointly develop an oil refinery to enhance the value of local crude and cut down fuel imports

Namibia's President Netumbo Nandi-Ndaitwah and Botswana's President Duma Boko have discoursed on the idea while the former's recent working visit to Gaborone.

Other areas of improvement considered was the diamond sector as the nation representatives agreed to engage their respective mining ministers for close coordination to advance revenue generation.

The Ministers also discussed ways to boost logistics and trade through Namibia's Port of Walvis Bay.

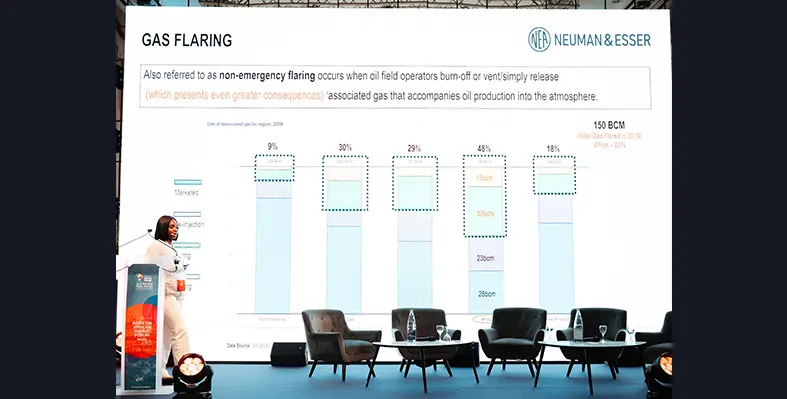

Flare Gas Utilisation: The Importance of Mid-Scale Integrated Gas Commercialisation Solutions. (Image source: Energy Capital & Power)

Africa has been paying a hefty price for a long time now as it lacks the right infrastructure to advance the practice of gas flaring

During a session at Invest in African Energy 2025 titled 'Flare Gas Utilisation: The Importance of Mid-Scale Integrated Gas Commercialisation Solutions', Nmesoma Okereke, sales manager and flare gas recovery specialist at Neuman & Esser, emphasised on addressing the challenge with scalable gas monetisation strategies.

“The most important reason for gas flaring is a lack of infrastructure, but also cost inefficiencies,” said Okereke. “In the past, it was more economically feasible to flare gas than develop or commercialize the gas. That is no longer the case with the rise of innovative gas solutions.”

Three of the world’s top nine gas-flaring countries are in Africa, said Okereke, collectively responsible for an estimated 60% of the continent’s gas flaring. Nigeria alone flared roughly 193 bn cu/ft of gas in 2024, while producing 2.5 trillion cu/ft of gas. Leveraging that wasted gas can generate as much as US$1bn, making a huge difference in a country where around 40% of the population is yet to experience the benefits of electricity.

Nigeria’s case study illustrates the dual challenge of wasted resources and unmet energy demand. According to Okereke, Nigeria needs five times its current domestic gas supply to reach its goal of 30 GW of power by 2030.

With flaring becoming less economically justifiable due to emerging technologies and modular gas utilisation options, Okereke emphasised the need to shift toward mid-scale integrated solutions that can bridge the infrastructure gap and bring gas to market more quickly and efficiently.