The AK-2H well in the Seme Field in Block 1, Benin, inches towards production as Akrake Petroleum Benin SA concluded drilling operations in the area

The company is now working on completion activities to make the well production-ready by early February. It has been designed to drain the western section of the Seme Field from the H6 reservoir.

The well will be screened covering the reservoir sandstone formation, and a down-hole electrical submersible pump (ESP) will be installed.

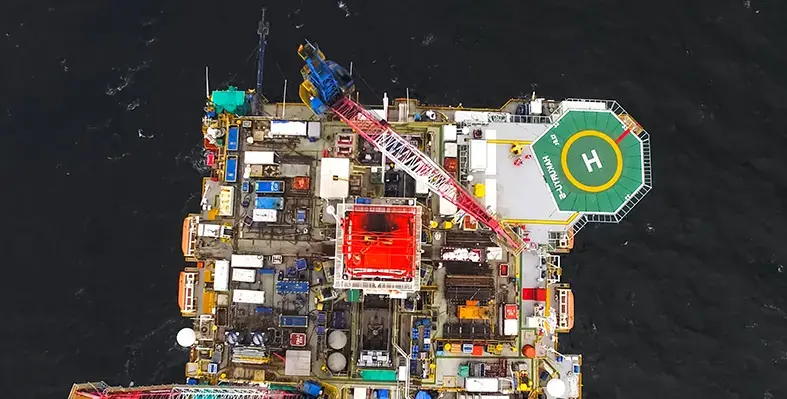

Alongside, installation of the mobile offshore production unit (MOPU), Stella Energy 1, and the floating storage & offloading unit (FSO), Kristina, are in the final stages.

The MOPU installation activities which involved flowlines connection set-ups and other technical addressing were responsible for some delays in production start-up.

Akrake Petroleum's Seme Field redevelopment campaign involves a 100-day three-well work-programme. It includes the drilling of two horizontal production wells in the H6 formation (previously developed), as well as a deeper vertical appraisal well to gather data from the H7 and H8 reservoirs, to facilitate the potential advancement to Phase 2 of the development.