Africa’s energy systems are deeply interconnected with global markets.

The escalating confrontation between the United States, Israel and Iran has introduced a new phase of geopolitical uncertainty into global energy markets

While the immediate focus remains on security implications in the Middle East, the commercial and operational consequences for Africa’s oil, gas and energy sectors are both significant and far-reaching. As global supply chains absorb the shock of rising tensions, African producers, exporters, importdependent states, and emerging energy markets are confronting a rapidly shifting landscape.

Africa’s energy systems are deeply interconnected with global markets. Crude exports, LNG flows, refinery feedstock, maritime transport and downstream pricing all depend on stable international conditions. When geopolitical volatility disrupts these conditions, the effects cascade across the continent’s upstream, midstream and downstream operations.

Oil price volatility and supply side uncertainty

The US-Israel-Iran conflict has injected renewed volatility into global oil markets. Brent crude prices have experienced sharp fluctuations driven by fears of supply disruption, potential sanctions and the risk of escalation in the Strait of Hormuz – a corridor through which roughly one fifth of global oil supply transits.

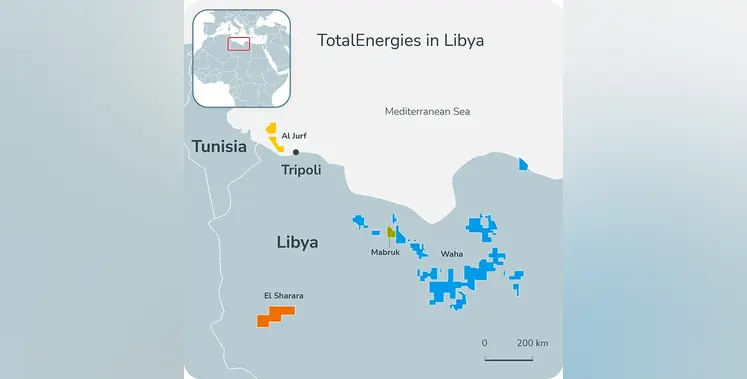

For established African producers and exporters – Nigeria, Angola, Libya, Algeria, Egypt, the Republic of Congo, Gabon, Equatorial Guinea and South Sudan – price volatility presents both opportunity and risk. Higher prices may boost short-term revenues, but instability complicates:

∙ fiscal planning

∙ production scheduling

∙ investment decisions

∙ long-term project financing

South Sudan is particularly vulnerable. Although it produces the crude, it relies entirely on Sudan for pipeline transit, refining and export through Port Sudan. Any geopolitical shock that affects global prices or regional stability amplifies the fragility of this arrangement already impacted by the internal conflict in Sudan.

For import-dependent African economies – Kenya, Uganda (until production begins), Rwanda, Tanzania, Ethiopia, Senegal, Ghana, and South Africa – price spikes translate into:

∙ higher fuel import bills

∙ inflationary pressure

∙ increased subsidy burdens

∙ downstream pricing instability

The conflict has therefore widened the divergence between Africa’s energy exporters and importers, with both groups facing heightened commercial risk.

LNG shipping disruptions and maritime chokepoints

The Red Sea, Bab elMandeb, and the Strait of Hormuz remain critical arteries for global LNG and petroleum shipments. Rising tensions have led to:

∙ vessel diversions

∙ increased war risk insurance premiums

∙ longer shipping times

∙ higher freight costs

∙ rerouting around the Cape of Good Hope

For African LNG exporters – notably Algeria, Egypt and Mozambique – these disruptions affect:

∙ delivery schedules

∙ contract performance

∙ shipping economics

∙ buyer confidence

Mozambique, in particular, is emerging as a major LNG player. Its offshore reserves position it as a future global supplier, but project timelines and financing conditions are highly sensitive to global LNG market volatility. Any instability in shipping routes or pricing affects investor appetite and project momentum.

For LNG importing markets in North and East Africa, rerouting adds cost and uncertainty to already tight supply chains, affecting power generation, industrial output and domestic energy security.

Infrastructure and upstream project risk

Energy infrastructure across Africa – pipelines, refineries, offshore platforms, LNG terminals and power generation assets – is highly sensitive to global market conditions.

The current geopolitical environment has intensified:

∙ EPC contract renegotiations

∙ project delays

∙ cost escalations

∙ supplychain bottlenecks

∙ financing challenges

Upstream investment decisions are being recalibrated as international oil companies (IOCs) and national oil companies (NOCs) reassess:

∙ fluctuating price decks

∙ higher insurance premiums

∙ sanctions exposure

∙ shipping and logistics risk

Emerging producers such as Uganda, Namibia and Ghana are particularly exposed.

∙ Uganda’s Tilenga and Kingfisher projects, along with the EACOP pipeline, depend on stable financing and predictable price environments.

∙ Namibia’s offshore discoveries have generated global excitement, but long-term development decisions hinge on market stability.

∙ Ghana, while already producing, remains sensitive to price swings and relies heavily on imported refined products.

These countries illustrate how geopolitical conflict affects not only current production but also Africa’s future energy trajectory.

Commercial and contractual pressure across the value chain

The combination of price volatility, shipping disruptions and project delays has increased contractual tension across the African energy sector. Key areas of pressure include:

∙ crude supply agreements

∙ LNG offtake contracts

∙ pipeline transportation agreements

∙ refinery feedstock contracts

∙ EPC and O&M contracts

∙ charter party and shipping arrangements

Force majeure claims, renegotiation requests and performance disputes are to become more common as parties struggle to meet obligations under rapidly changing conditions.

This is where commercial risk management becomes essential.

Why ADR is becoming critical in Africa’s energy sector

In a period of heightened geopolitical uncertainty, effective, neutral dispute resolution capacity is no longer optional – it is a strategic necessity.

Energy disputes often involve:

∙ crossborder parties

∙ complex technical issues

∙ high value contracts

∙ time sensitive operations

∙ confidentiality requirements

Alternative Dispute Resolution – particularly arbitration, mediation and expert determination – offers:

∙ neutrality

∙ enforceability

∙ sector-specific expertise

∙ procedural flexibility

∙ continuity of commercial relationships

As global conflict continues to reshape commercial risk, African energy companies, investors and governments increasingly require dispute resolution professionals who understand both the geopolitical landscape and the operational realities of the oil and gas sector.

Africa’s energy future in a volatile world

The US-Israel-Iran conflict has underscored a fundamental truth: Africa’s energy markets are deeply exposed to global geopolitical shocks. From upstream investment to LNG shipping, refinery operations and downstream pricing, the continent’s oil and gas sector must navigate a more volatile and interconnected world.

For African producers, importers and infrastructure operators, resilience will depend on:

∙ robust commercial risk management

∙ flexible contracting strategies

∙ diversified supply chains

∙ and access to principled, neutral dispute resolution mechanisms

In this environment, the ability to anticipate disruption – and resolve disputes efficiently when they arise – will be essential to sustaining Africa’s energy growth and stability.

The article has been written by Elijah Paul RukidiMpuuga, FCIArb, International arbitrator and founder, Equitas Dispute Resolution Group