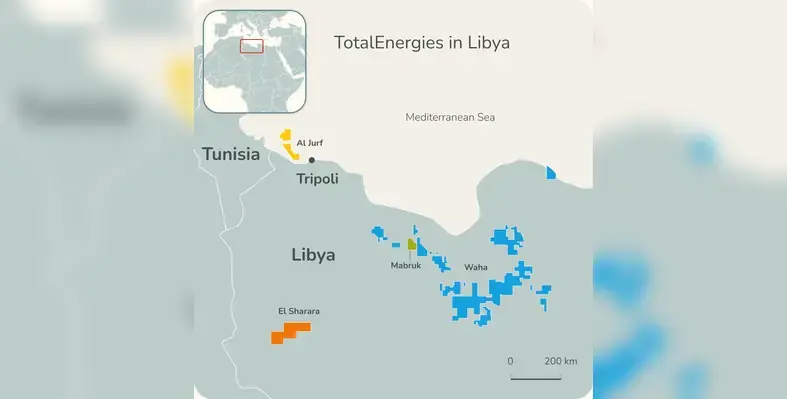

Libya’s National Oil Corporation has signed a memorandum of understanding (MoU) with MOL Group for hydrocarbons exploration, technological and field development innovations, oilfield services opportunities, and crude supply and trading activities

Signed in Budapest by MOL group chairman and chief executive officer, Zsolt Hernadi, and chairman of the NOC, Masoud Suleman, this is a strategic partnership for the Hungarian oil and gas company as it aims to expand its international portfolio and secure diverse supply sources as a landlocked country.

Speaking on the collaboration, Hernadi, said, "We recognise Libya’s oil and gas industry as a pillar of strength and expertise. I am sure that this new agreement will act as a catalyst for further expanding our international portfolio, creating clear mutual value for both companies and reinforcing the resilience of our region. From the perspective of security of supply and energy sovereignty, particularly for landlocked countries, diversification of sources is of crucial importance."

Joint exploration potential besides, the mutual collaboration will advance exchange of information as well. "Our cooperation also goes beyond business, as we have agreed to rebuild our educational, scientific, and university ties in order to learn as much as possible from each other. Such partnerships can also help Europe to find its own path to competitiveness, rather than switching between different forms of energy dependency,” said Hernádi.