While June output reflected improved production cut compliance in OPEC + group, Rystad Energy has observed that countries such as Sudan, South Sudan, Nigeria, Gabon, Equatorial Guinea, and Congo-Brazzaville, among others, continue to overcomply with the official cuts

Nigeria was one of the countries whose output recovery shot production rates from non-voluntary cutters to 3.044 mn bpd, which is 142,000 bpd higher than in May.

While Nigeria recovered, it still fell short of target (210,000 bpd in June), one of the primary reasons of undercompliance from 10 of the member countries, whose production this month was 3.435 mn bpd – 142,000 bpd higher than in May.

Tension between Sudan and South Sudan has also impacted their production as June output in South Sudan was only 48,000 bpd – 76,000 bpd lower than its target. Sudan, on the other hand, produced only 31,000 bpd – 33,000 bpd below its quota.

Strong compliance among member countries

Despite increases from Nigeria (39,000 bpd) and Brunei (45,000 bpd), overall figures for June show that OPEC+ production dropped by 140,000 to 40.911 mn bpd, especially due to lower output in Russia (173,000 bpd) and the UAE (76,000 bpd).

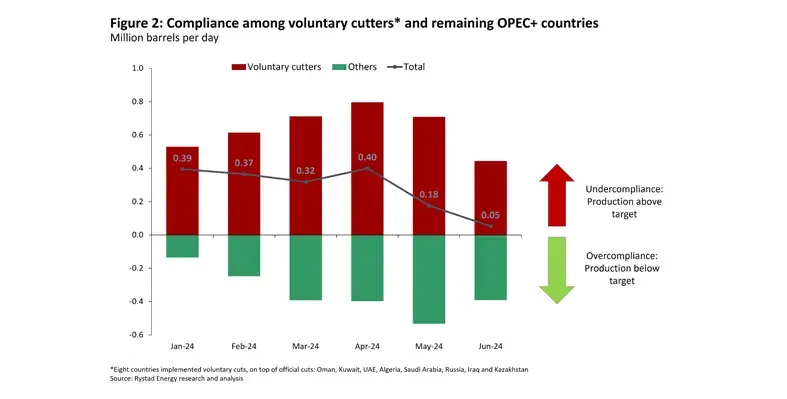

The group’s overall production was only marginally above its target by just 53,000 bpd – its lowest level since the start of the year. This pointed to improved compliance as observed by Jorge León, senior vice president - oil market research, Rystad Energy, who said, “The recent improvement in compliance levels with the OPEC+ cuts show strong commitment and cohesion inside the group. It also shows that the compensation mechanism put into place is working. I expect to see strong compliance continuing in the coming months.”

Compliance among the eight voluntary cutters – Oman, Kuwait, the UAE, Algeria, Saudi Arabia, Russia, Iraq and Kazakhstan – has improved.

Kurt Barrow, head of oil markets, S&P Global Commodity Insights observed last year that crude pricing in 2024 depends on OPEC+'s ability to follow through on voluntary production cuts. Maintaining discipline among member countries can be especially difficult due to strong non-OPEC+ supply growth and slowing oil demand growth.