Low oil prices, combined with the COVID-19 pandemic, are putting pressure on oil and gas companies to reduce operational costs through efficiency and optimisation

There is only a limited number of ways to achieve this — by downsizing, reducing production, or implementing digital transformation. While a quick fix, downsizing and production reduction are not sustainable solutions. As such, more and more oil and gas companies are looking at the strategic advantages of digital transformation, driven by cloud computing, Internet of Things (IoT), big data, and artificial intelligence (AI).

Digitisation: A Must for the Oil and Gas Industry

According to Accenture Technology Vision 2019, of the 168 oil and gas executives surveyed, 85 per cent from upstream and 90 per cent from downstream companies said that they were currently implementing one or more of the following technologies: Distributed Ledger Technology, AI, Extended Reality, and Quantum Computing (DARQ).

In recent years, most large oil and gas companies have increased investment in digital transformation. Internationally, large multinationals have launched their own digital and intelligent oilfield construction plans, such as the Digital Oilfield by ExxonMobil, Integrated Development by ConocoPhillips, Smart-Field by Royal Dutch Shell, I-Field by Chevron, and E-Field by BP.

Chinese enterprises have also been actively implementing new digital strategies in the industry. China National Petroleum Corporation (CNPC) has built an exploration and production cloud platform, as well as over 50 digital management systems, including exploration and development, refinery and chemical engineering, and service support, among others. Sinopec has set up three digital platforms for operation management, production operation, as well as information infrastructure and O&M. In addition, it has built several technology-driven solutions, such as ProMACE, smart factory, Chememall, and Epec.

At the same time, China National Offshore Oil Corporation (CNOOC) is developing on-going plans for intelligent oilfields. It has successfully built unmanned platforms, and has piloted multiple projects on intelligent exploration, oil production, asset management, and drilling and completion.

Oil and gas companies are rapidly investing in digital and intelligent projects to improve exploration and development efficiency and reduce production costs. Ultimately, the industry looks to seize the opportunities that digital transformation has to offer.

A Difficult Road to Digital Transformation

Each upstream enterprise progresses at a different pace during digital transformation. Various companies in the oil and gas industry have achieved different levels of development in data monitoring and collection, device networking, data analysis, and predictive maintenance; the industry overall has had some success in these domains. However, the further the industry transforms digitally, the more challenges it faces.

Zhang Tiegang, former Deputy Chief Engineer of Daqing Oilfield Exploration and Development Research Institute, introduced the three major pain points in the digital transformation of the oil and gas industry at the Huawei Oil and Gas Virtual Summit 2020 held on 15 July.

-Massive Data Growth

Compared with other industries, oil and gas manages an even larger amount of data. For example, the amount of seismic data is increasing at an unprecedented speed. As oil and gas exploration becomes more difficult, the process requires more precise seismic wave exploration techniques. Broadband, wide-azimuth, and high-density (BWH) seismic data collection is particularly important, amounting to nearly 1 TB/km2. The exploration area is constantly expanding and the originally collected high-resolution seismic data in just a single work area may amount to over 17 TB. In addition, the continuous increase in historical data records further speeds up data growth.

-Increased Computation Workload and Complexity

The ever-increasing data volume leads to a sharp increase in the computation workload. For example, the computation workload of pre-stack reverse time migration (RTM) and storage volume are 10 and 50 times higher than before, respectively. To ensure comprehensive and accurate understanding of oilfield production dynamics, the computation requirements of large-scale reservoir numerical simulation also increase significantly. Therefore, oilfield companies have increasingly high requirements on data processing technologies. More and more complex algorithms — such as anisotropic pre-stack depth imaging, RTM, and full waveform inversion (FWI) — also pose higher requirements on computational capabilities.

-Weak Information Infrastructure

Equipment rooms, computing, storage, and IT O&M constitute the information infrastructure system of oil and gas enterprises. Most companies used to build their own, resulting in many equipment rooms with high energy consumption and low security. At the same time, low server configuration and utilisation are no longer able to meet the requirements of massive data processing. In addition, the existing shared storage devices come from different providers and feature low capacity, unable to store massive data. Moreover, O&M departments face increasing pressure to hire highly skilled personnel to ensure the O&M of independent and scattered IT with a poor intelligence level.

Partnership Can Help Oil & Gas Streamline Digital Transformation — Who Will the Partners Be?

The digital transformation of oil and gas enterprises is a huge systematic undertaking. Therefore, technical support from IT companies is indispensable.

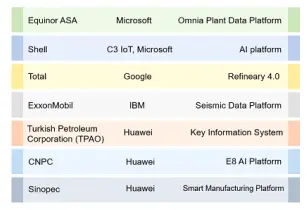

Every large oil company has chosen to form partnerships for digital transformation. In this case, IT companies provide oil and gas enterprises with comprehensive digital solutions by using advanced technologies such as AI, big data, and cloud computing.

Every large oil company has chosen to form partnerships for digital transformation. In this case, IT companies provide oil and gas enterprises with comprehensive digital solutions by using advanced technologies such as AI, big data, and cloud computing.

Take the partnership between Huawei and Daqing Oilfield Company as an example. Cloudification is key for digital transformation. However, data, computing, and facilities present serious challenges. To address these, Daqing Oilfield Company cooperated with Huawei to build a cloud data centre, achieving an elastic supply of IT resources. The computing power of the data centre now reaches 1,000 trillion FLOPS — a 300 per cent increase in efficiency.

Thanks to the elastic supply of computing and storage resources, the acquisition period has been reduced from three days to three hours. At the same time, servers with super computing power and the cloud-based deployment environment optimise data processing by three to 10 times. To achieve this, production data is transmitted to the cloud centre through the high-speed dedicated network for processing. The calculation results are automatically sent back to the data centre for archiving and management, ensuring the security of the core oilfield data.

In addition, Huawei has developed multiple technical service capabilities for oilfield digitisation by using technologies such as AI, big data, and 5G. By deploying HUAWEI CLOUD, SONATRACH (Algeria) has successfully transitioned to cloud-based IT by deploying a company-wide ERP system. With AI, big data, and industrial IoT technologies, Huawei has built a fault prediction model for predictive maintenance of pumping units. Huawei has also built the largest industrial 5G oilfield lab in Europe's biggest oil refinery, as well as implemented future-oriented services such as inspection robots, wireless sensors, ‘connected’ employees, and predictive maintenance. Recently, Shengli Oilfield and Huawei recently signed a strategic cooperation agreement to build a cloud platform and 5G-based intelligent oilfields.

Efficiency and cost are the competitiveness indicators of the oil and gas industry. As a leading global ICT solutions provider, Huawei is continuously working with oil and gas partners to reduce costs, increase efficiency, and achieve digital transformation.

Improved efficiency

In line with the strategy of increasing reserves and production, how to maximise value from historical exploration and development data has become a new requirement of CNPC. Together with partners, Huawei planned and built a computing AI platform for CNPC, to implement AI training and big data analytics. The customer has now applied AI in multiple ways, such as artificial lift fault diagnosis and seismic first arrival wave identification. The value of underused historical exploration and production data has been fully explored.

Reduced cost

Huawei built a local, dedicated cloud for Daqing Oilfield, to provide oil and gas exploration computing. This in turn helped Daqing to optimise its costs and shift high-performance exploration and development computing services from CAPEX to OPEX. By reusing ten PB of historical exploration data, the cloud helped improve computing power by 833 per cent, and increase the annually processed area from 400 sq km to 2000 sq km.

Strong partnerships are essential in the oil and gas industry, regardless of the digital transformation strategies a company may adopt. Alone, digital transformation is difficult, due to its complex technical requirements. The key for success is to build strong and strategic partnerships with industry leaders, ensuring a clear scope of cooperation. In this period of digital transformation, it is critical for oil and gas enterprises to choose their partners wisely — it will define the industry trends, but more importantly, it will determine who will become the new industry leaders.