ConocoPhillips and Statoil Petroleum AS have signed a joint sponsorship development agreement with Visuray Technology Limited, to fund the development of an innovative downhole technology that can evaluate the integrity of cement behind multiple casing strings in oil and gas wells

Technology

Twister continues Petronas partnership with delivery of CO2 crystalliser pilot skid

Twister BV and Petronas have organised a joint development programme to use Twister technology for the monetisation and processing of acid gas fields containing large amounts of CO2

Eni introduces HPC4 for advanced computing system across oil and gas industry

Eni has launched its new HPC4 supercomputer, aiming to quadruple its computing power and make it one of the world’s most powerful industrial systems

TGT announces well diagnostics breakthrough

TGT Oilfield Services, provider of through-barrier diagnostic systems, has announced the successful validation of its electromagnetic EmPulse well inspection system in high chromium tubulars

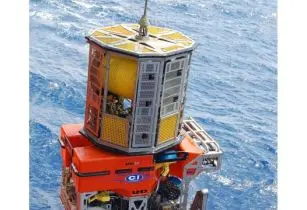

C-Innovation forms subsea projects group for an integrated subsea solutions

C-Innovation, LLC (C-I), an affiliate of Edison Chouest Offshore (ECO), has formed a turnkey subsea projects group to provide a complete solution to its global customer base