Oil and gas businesses need to adapt to automation and digitalisation to reshape and revitalise their workforces, according to the second annual Global Energy Talent Index (GETI), one of the world’s largest energy recruitment and employment trends reports

Technology

ABB Displays EOW- i3 control room concept for oil and gas at EGYPS 2018

Aiming to take digitalisation to the next level for oil, gas and chemicals, ABB highlighted its EOW- i3 extended control room concept at EGYPS 2018, running in Egypt from 12 – 14 February 2018

Ardiseis and CGG complete highest-density seismic survey for onshore and oddshore

Ardiseis, subsidiary of the Arabian Geophysical and Surveying Company (ARGAS), and its technology partner, CGG, have completed the world’s highest-density broadband seismic survey for onshore and offshore

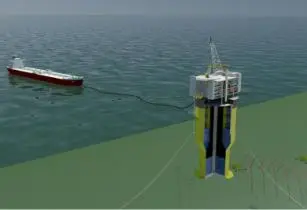

Atkins’ low CAPEX floating platform granted the US patent to unlock marginal fields

Atkins, member of the SNC-Lavalin Group, has been awarded the US Patent (US9828072) for its marginal field production facility, the Deep Draught Production, Storage and Offloading (DDPSO)

BHGE announces new technology deals and partnerships for oil and gas industry

Baker Hughes (BHGE), a GE company, announced a series of new contracts and partnerships at its two-day event in Florence from 29-30 January 2018, which assembled more than 1,000 senior oil and gas and government leaders