The toll of the Covid-19 pandemic on upstream investments in the first two years of the downturn is estimated at a whopping US$285bn, and although spending will slowly start to rise from 2022, it will not reach pre-crisis levels in the coming period, according to a Rystad Energy report

In February 2020, before Covid-19 started impacting the global energy system, Rystad Energy estimated global upstream investments for the year would end up at around US$530bn, almost at the same level as in 2019. Its forecast at the time suggested 2021 investments would remain in line with the previous year’s level.

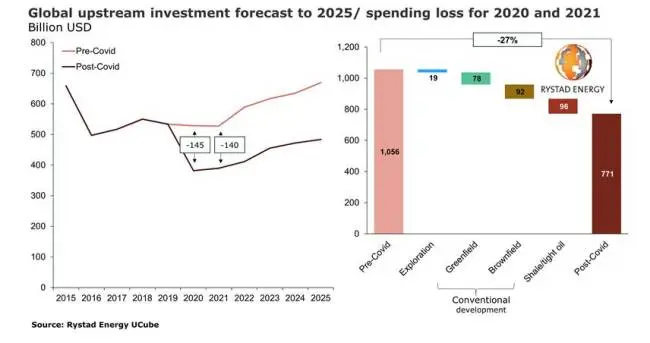

However, as the Covid-19 pandemic triggered a collapse in oil prices during the early part of the second quarter last year, E&P companies slashed investment budgets to protect cash flow. This spending trend was not reversed in 2021, when prices rose. Compared to pre-pandemic estimates for 2020 and 2021, Rystad observes that spending fell by around US$145bn last year and will end up losing US$140bn by the end of this year. This implies Covid-19 removed 27% of planned investments.

Upstream spending was limited to US$382bn in 2020 and is forecast to marginally grow to US$390bn this year. Rystad Energy expects the effect of the pandemic to be a lasting one as – even though spending will start growing from 2022 – it will not return to the pre-pandemic level of US$530bn. Growth will be limited and investments will only inch up annually, rising to just over US$480bn in 2025, when this report’s forecast ends.

Over the two-year period between 2020 and 2021, shale/tight oil investments are the ones most affected in both absolute and percentage terms, losing US$96bn of the previously expected spending, or 39% for the sector. Exploration spending is expected to drop by US$19bn, or 22%, compared to what was previously forecast. Greenfield investment in new conventional projects will suffer a US$78bn loss, or 28%, while brownfield investment in existing such projects will fall by US$92bn, or 20%.