The projection of a cumulative loss of US$340bn over the next eight years comes as peak oil demand will arrive earlier and at a lower level than expected, meaning E&P investments will be reduced.

The pandemic's effect and the accelerating energy transition last month meant Rystad Energy revised its peak oil demand forecast. The peak oil demand is now forecasted for 2028, two years earlier than previously expected, at 102 mmbbl per day, down from previous projections of 106 million.

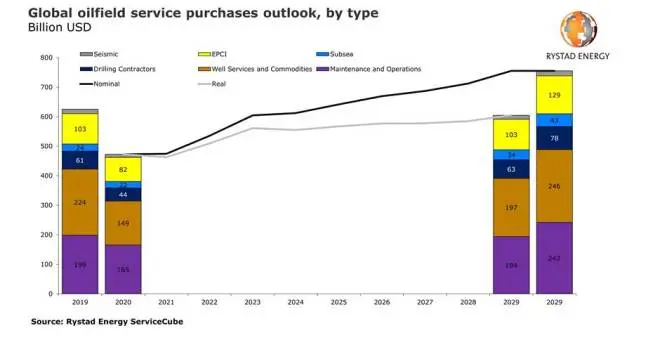

OFS purchases are expected to drop to US$473bn (from US$625bn in 2019) and remain flat in 2021, before beginning a slow recovery. Rystad Energy predict OFS purchases will return to pre-pandemic levels after 2024, reaching US$642bn in 2025. The US$340bn in lost purchases value is spread across the next eight years, calculated as the different between the current and the previous forecasts for peak oil demand, which corresponds to a 6% drop.

Investments are expected to increase by 13% in 2022 (the expectation was previously 17%) and 16% in 2023 (18% previously). Most of the revisions were driven by shale investments, which were expected to grow by 45% in 2022 but are now pegged at around 30%.

“With a lower need and willingness among E&P companies to invest in oil and gas, capital expenditure across offshore, shale and conventional onshore resources will probably struggle to get back to 2019 levels,“ says Audun Martinsen, head of energy service research at Rystad Energy.