The International Energy Agency (IEA) has released their Oil 2021 and Coal 2021 reports which indicate that the global economy and oil markets are recovering from the historic collapse in demand caused by the coronavirus pandemic in 2020 and that the economic recovery is driving global coal power generation to a record this year, with overall coal demand to a potential all-time high as soon as 2022

According to IEA’s oil market analysis, global oil demand rebounds from nine-year low of 91 mb/d in 2020 to 104 mb/d in 2026. After a strong recovery in oil demand globally through 2022-23, oil demand in high-income economies stagnates while robust demand growth continues in developing economies in the second half of the forecast.

The forecast shows sharp spending cuts and project delays in response to low oil prices in 2020 are already constraining growth in almost all oil producing regions. Yet, global capacity is projected to increase 5 mb/d by 2026 versus 2020. Libya is expected to provide a substantial near-term boost to OPEC crude supply over the forecast period after the September 2020 lifting of a blockade that shut in production. However, the situation remains fragile under a new interim government and recent gains of more than 1 mb/d could be at risk of disruption.

Crude oil capacity largely declines in African OPEC+

Libyan supply rebounded strongly to top 1 mb/d in November 2020 after the end of an eight-month blockade that cut flows below 100 kb/d. Crude oil capacity in Angola is set to fall 330 kb/d, to just above 1 mb/d by 2026 as operational and technical issues beset high-cost deepwater oil fields. In Nigeria, crude oil capacity declines from 1.8 mb/d in 2020 to 1.6 mb/d by 2026 due to underinvestment.

“The oil price collapse, in addition to an increase in deepwater government royalties, may prompt IOCs to review projects. Total reportedly has pushed back development of the 70 kb/d deepwater Preowei field and is seeking to sell its 12.5% stake in deep water OML 118, which includes the Bonga field. Output from the block is expected to rise whenever the Shell-operated Bonga Southwest project gets off the drawing board. However, the final investment decision on the project may be further delayed by uncertainty over commercial terms,” stated the oil market analysis.

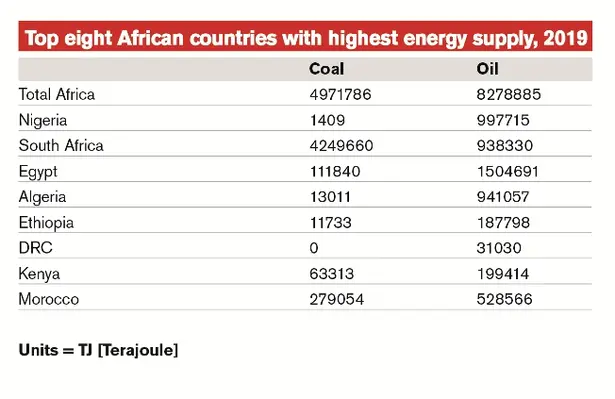

Coal: African rates to remain low

IEA’s report indicated that the total coal consumption of the continent decreased to 198 Mt in 2020 and, although consumption is expected to steadily rise, it will only reach 212 Mt by 2024 which remains below pre-pandemic levels. This is far below the levels of other international communities with Europe expected to hit a total coal consumption of 508 Mt by 2024 and North America reaching 462 Mt in the same period. All three are, however, dwarfed by Asia Pacific which is predicted to reach 6,430 Mt by 2024.

In addition, African countries are being affected by China’s pledge to stop funding coal-based power plants abroad. Botswana, Tanzania, Mozambique are among those expected to be most affected by this as they have been counting on Chinese financing to increase their coal-fired generation capacity. However Zimbabwe is probably the most concerned as it has 990MW of coal-fired plants under construction with plans for another 4.5GW of additional capacity – Chinese institutions are the main source of capital for these.