The momentum of coronavirus in the USA and key European oil and gas centres represents a critical supply risk for oil and gas operators around the world, according to a report by Andy Tidey from energy consultancy Wood Mackenzie’s consulting team

In the report, entitled ‘Exposing and managing risks in oil & gas supply chains’, it is argued that the global nature of the oil industry and its supplier network means that vulnerabilities within oil supply chains, when exploited by dynamic combinations of simultaneous risks, such as the current combined coronavirus and crude price shocks, result in major disruptions to oil operator operations.

The painful combination of demand shock, supply expansion and the evolving disruption and uncertainty created by COVID-19 comes at a bad time for upstream services and equipment suppliers who are still recovering from the last downturn. The resilience of the upstream supply chain is now at risk, which poses major challenges for the entire sector.

Two fundamental challenges exist for suppliers to the upstream sector, the report says:

• COVID-19 has disrupted the supply of manufactured equipment and the ability to transport service personnel across borders

• Services providers are in much worse financial shape than in 2014/15. Margins are thin and balance sheets stretched with high probability of further consolidation, restructuring and insolvency in the supply market, leading to reduction in investment in technology, equipment and associated services.

From this downturn, the upstream oil and gas supply chain will emerge smaller and probably leaner, with some supply chain interruptions. It will have less capacity to respond to demand growth when the market recovers. Whilst there may be opportunities for operators to extract minor price concessions in this lean period, the stability of the global upstream supply chain represents a major risk.

From this downturn, the upstream oil and gas supply chain will emerge smaller and probably leaner, with some supply chain interruptions. It will have less capacity to respond to demand growth when the market recovers. Whilst there may be opportunities for operators to extract minor price concessions in this lean period, the stability of the global upstream supply chain represents a major risk.

Understanding and managing supply chain risk will be a critical downside challenge for upstream operators in the immediate future. Operators will need to put in place more comprehensive approaches to supply chain risk management which will result in more resilient supply chains, the report recommends:

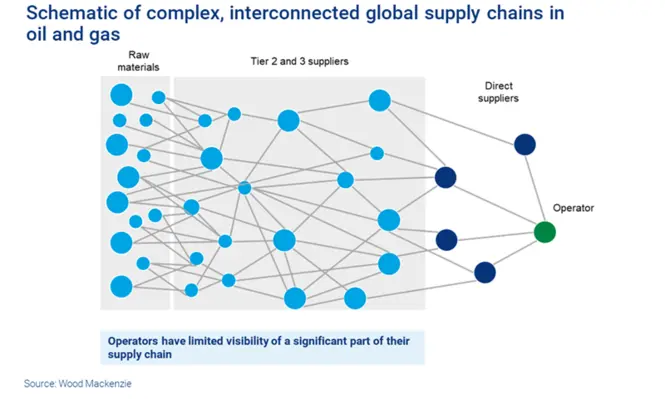

Understand and map the supply chain: understand breakdown of third party spend, suppliers and supply routes , have a clear understanding of what is purchased from whom and where, and the associated steps in the supply chain required to get the product or service to the destination.

Of critical importance to the oil and gas industry are the specialist technical knowledge and skills in the North American and European supplier networks residing in epicentre regions such as in Houston, or manufacturing hubs such as Milan. The reliance on these centres, combined with the opaque tiering of supply chains beyond immediate tier 1 suppliers, will be an issue for many of the complex pieces of kit and personnel required in the upstream oil sector. Understanding the make-up of suppliers can also be a challenge. Many of the major suppliers are large and complex groups and will contract through multiple entities.

Identify supply chain risks or events with the potential to adversely impact an organisation or the supplier’s ability to meet its supply chain objectives: Oil and gas organisations need to have a profound understanding of the drivers of risk for their organisation - political, economic, environmental, human rights and security - then build a ‘risk intelligence capability’ to detect emerging threats early and to act upon them.

Forecasting of supply chain risks in the case of such severe events as the coronavirus pandemic requires specialised capabilities. Risk models encompassing exposure footprints of suppliers, hazard event histories, probabilities and intensities, and business interruption impact data, are required to help organisations properly prepare and assess supply chain exposures and potential impacts of catastrophes.

Identify supply chain vulnerabilities: identify exposures caused by gaps in an organisation’s supply chain capabilities that either increases the likelihood or the severity of a risk event. If operators can identify risks to their supply chain, they stand a better chance of addressing vulnerabilities to cope with these risks. Operators should build supply chains that can quickly adjust and recover from supply chain disruptions.

As far as the specific impact of COVID-19 is concerned, the region and city level variation in infection rates is a key determinant of current supply chain disruptions, the report points out. Understanding infection rates and local restrictions on business activity is critical. The global impact of COVID-19 is evolving rapidly and on a daily basis – operators need to be on the front foot to understand how disruptions in the near future could impact operations, eg. through scenario modelling and regular impact assessments.

Even when manufacturing and distribution facilities come back on stream, ongoing travel restrictions will impact the ability to move skilled people to operating facilities. Reduced airline services and shipping operations between key source and destination locations could remain at reduced levels for prolonged periods.

Companies will also need to consider how resilient their suppliers are to the demand crunch. The financial health and structure of the business and the potential government support are important factors, and the impact on order books needs to be assessed. For rig and vessel operators, for example, understanding relevant sectoral supply demand balances and impact on pricing and volumes will be critical.

At some point the industry will return to some level of normality, but the oil and gas industry and its supply chains are likely to look very different, the report concludes. Another wave of disruptions and supply challenges could occur if there are surges in demand for services and equipment, particularly if there are to be significant reductions in supply chain capacity. Operators should start developing contingencies to manage the post-crisis period, and ensure that they will have access to a robust supply chain.