Data and analytics company, GlobalData, has found a significant decline of 22% in disclosed oil and gas contract volume from 7,550 contracts in 2022 to 5,915 in 2023

Despite this decrease, the industry managed to maintain momentum in contract value, primarily fueled by contracts for major projects such as North Field South LNG, Golden Pass LNG, Hail and Ghasha field, Agogo FPSO, and the expansion of the Amiral petrochemicals facility, amidst challenging market conditions, reveals GlobalData, a leading data and analytics company.

The company's latest report, 'Oil and Gas Industry Annual Contracts Analytics by Region, Sector, Planned and Awarded Contracts and Top Contractors', reveals that the total disclosed contract value kept momentum at US$187.48bn in 2023, only slightly lower than the US$189.94bn reported in 2022.

Pritam Kad, oil and gas analyst at GlobalData, said, “This resilience is attributed to high-value contracts from notable contractors such as Technip Energies and Consolidated Contractors' that secured $10 billion EPCC contract for QatarEnergy’s North Field South LNG project. Tecnimont’s US$8.7bn, Saipem and NPCC Consortiums’ US$8.2bn EPC contracts for the Hail and Ghasha Development Project in the UAE, Yinson Holdings’ US$5.3bn Agogo FPSO charter and maintenance, and Hyundai’s US$5bn EPC work for Amiral petrochemicals facility expansion in Saudi Arabia.”

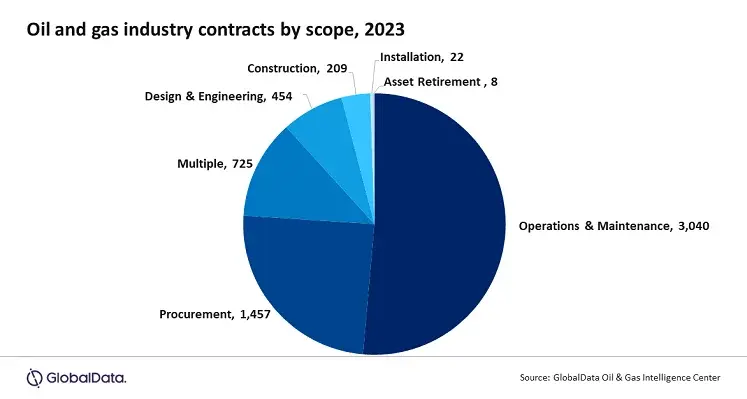

Operations and maintenance (O&M) represented the majority with 51% of the total contracts in 2023, followed by procurement scope at 25%, and multiple scopes, including construction, design and engineering, installation, procurement, O&M, and asset retirement, accounted for around 12% of the contracts.

The most prominent of the contracts were Technip Energies and CCC JV’s US$10bn EPCC contract for QatarEnergy’ two mega LNG trains with a capacity of 8 mmtpa each, along with associated facilities as part of the North Field South (NFS) project in Qatar; Tecnimont’s approximately US$8.7bn EPC, and Saipem and NPCC’s US$8.2bn EPC for processing plants, drilling centers, pipeline and utilities infrastructure for the Hail and Ghasha Development Project in Abu Dhabi, UAE.

Additionally, Yinson Holdings’ US$5.3bn contract for Agogo FPSO charter and operation and maintenance work, and Hyundai’s US$5bn EPC work for mixed feed cracker (MFC) and utilities, flares and interconnecting facilities at the Amiral petrochemicals facility expansion in Saudi Arabia.

“The oil & gas industry's ability to secure high-value contracts for major projects underscores its enduring strength and adaptability in navigating turbulent times,” said Kad.