Crystol Energy's founder and chief executive officer, Dr. Carole Nakhle, moderated an Africa-focused panel during the recently concluded International Energy Week in London to get a perspective on the continent's stand on decarbonisation and energy transition practices

"It's not saying that decarbonisation should be ignored, but the truth is, you can't decarbonise what you don't have. If you don't have energy, you can't be talking about decarbonisation. You have to have the energy faster than you decarbonise," said the Nigerian National Petroleum Company's chief financial officer, Adedapo Segun, in the context of poor energy access in Africa.

Segun's case was further supported by Renaissance Africa Energy Company's managing director and chief executive officer, Tony Attah, who said that with a teeming youth population, Africa cannot compromise on industrialisation. "I think it's a no brainer that from an African lens, from a Nigerian lens, industrialisation is what will move people out of poverty. We want to be given the flexibility to use the same resources to achieve what Europe and the rest of the world has achieved. From an African lens, it's survival first. I haven't survived. You're asking me to make a choice. It's about the industrialisation of Africa...when you talk about the whole emissions and impact on climate, data suggests that the entire Africa is contributing way less than 4% so essentially, we can even carry on at two, three times the scale today, and it will not be of any significant impact," Attah said.

While Dr. Nakhle was all ears, she stressed Africa's responsibility to eliminate flaring for sustainable production. "Just by increasing the penalty on gas flaring, you motivate the companies to actually still produce oil and gas with lower carbon intensity, because I think that would be the winning step for the future, and not to continue with what was a good old fashioned way of producing oil and gas."

According to Attah, flaring has been a focus area for most creditors as part of decarbonisation strategy, which aligns with attaining zero routine flare by 2030. With engineers working on projects to deal with gas storm compression infrastructure that are capable of moving gas from flood centres to the market, there has been a massive reduction in flare now.

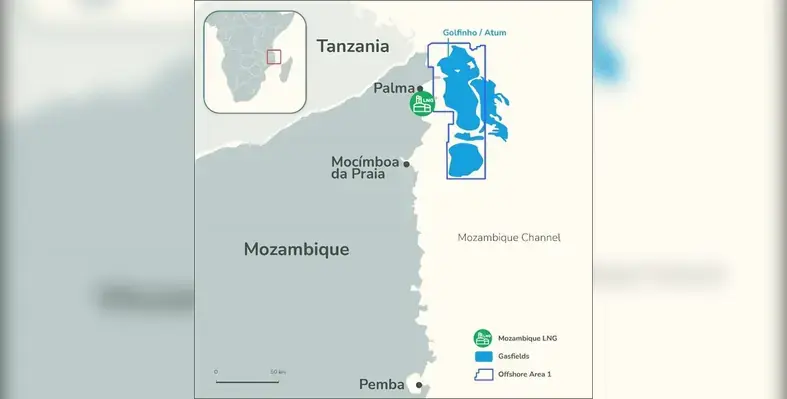

Gas is already driving Africa's energy narrative, with around 620 trillion standard cubic feet coming solely from Algeria, Mozambique and Nigeria. The world has come to Africa with massive investments, not just for international market but also the domestic market. The nation is hence way past the stage of "making a case", as now its just a matter of the investments unleashing the potential that is trapped in all these countries.

"Gas is going to be the game changer for us. So we are looking to develop our gas resources and export the gas to derive the financing for developing the country, and bridging the infrastructure gap," said AGPC's managing director, Effiong Okon, as he gave some perspective on Nigeria's national budget against the infrastructure budget of European countries.

"We have a budget of just about 20 something million dollars. That is for the whole country, and 45% of that goes to debt service. Another 15% goes to security. So you have 60% of the budget locked in debt service and security. And with that, you really cannot build infrastructure. You need to improve the standard of living. It becomes impossible. I checked on some of the European countries, Germany, for example, for just for infrastructure in 2026 [it is] going to spend close to US$200bn. So we really need to find the prosperity to develop," he said.

Dr. Nakhle also raised the question of Africa's biggest paradox. "Africa is rich in energy resources, and yet it is poor when it comes to energy consumption. What do you think needs to change to change this reality on the ground?" she asked.

Attah's answer was that Africa is looking at a typically extractive industry when it comes to oil and gas. While the resource belongs to the nation, it was entirely under the control of international oil companies. Due to this structural dislocation, IOCs will extract, go and develop their respective countries with it. But now with majors announcing massive divestments on the back of onshore maturation, companies like Renaissance were feeling the heat. "But I have to thank NNPC for just supporting the divestment to go through. So we bought the share assets, and you can imagine that our philosophy and vision will be different from that of an IOC. We have a very audacious vision to be the African leader in energy. The IOC will not want to be the African leader in energy. They want to be the global leaders, but we want to be the African leader in energy. We want to enable energy security, [and] we want to bring about the industrialisation of Nigeria. Now that was not an assignment for the IOC...We are now taking our destinies in our hands to the extent that we will have no choice than to ensure that that shared prosperity from this energy resource base changes the narrative. On behalf of Nigerians, starting from Nigeria, pivoting to rest of Africa, which is why we like to say as Renaissance, we were made in Nigeria, built for Africa," he said.

On the energy transition front, Silvia Macri, Middle East and Africa lead, Power & Renewables, S&P Global, said, "If you think about diversification, some countries in western Africa, Kenya in eastern Africa, are pushing either away from a fossil fuel heavy energy mix, or diversifying the sources, instead of having one major source of the produces, power or energy for the country; just choosing all the different options that are available. And this is something that South Africa, for example, has started doing at a faster pace. Kenya is probably the country where this has happened at the highest level, because it has a huge availability of geothermal resources, which allowed the diversification into renewables, but western African countries are bringing gas generation in the mix together with renewables...going forward, [it is important that] the decisions that they're making are more for the longer term, and they're not just solving the problem that is immediate."