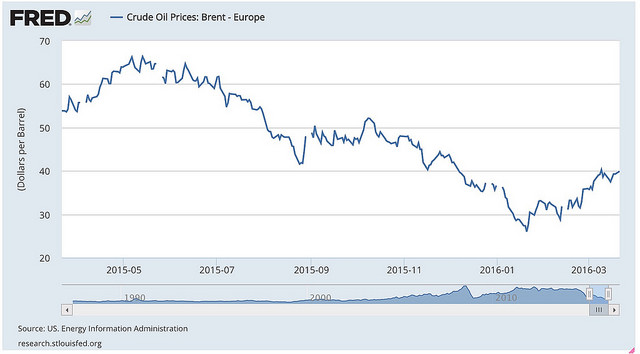

By the end of June 2016, oil prices could be up to US$57 a barrel and US$73 by 31 December 2016

This was the prediction from Richard Savage, head of energy research for Mirabaud Securities, when he spoke at the 14th Africa Independents Forum. In a broad-reaching presentation, he outlined the multiple factors behind the oil price drop, explaining that "it is a supply issue, not a demand issue".

"Demand has been reasonably stable," said Mr Savage. He explained that initially the US led the charge towards oversupply but more recently, "this mantle was taken up by OPEC [with] Saudi Arabia, Iraq and Ian as the three main culprits". He said the rationale behind these three countries overproducing oil was "let's flood the market to drive out excess investment in the industry".

In 2016, Saudi Arabia and Iraq stagnated but Mr Savage said this still left Iran to overproduce oil, particularly once sanctions were lifted.

He also explained that despite a much lower rig count at the time of writing (208) than in October 2014 (1,134), the US industry has still recorded a "sharp uptick in production since 2015".

"The US industry is very good at adapting to change," he told the conference, explaining that even with fewer well drilled, they are being exploited more efficiently.

"[US producers will] focus on the best wells and the more successful wells - if the rig count goes up again, productivity will go down," said Mr Savage.

Other factors cited by Mr Savage as impacting on oil price included refiners using cheap imported crude rather than local oil, a trend since 2004 for financial players to influence oil price rather tha producers, and an increase in inventories which started in 2009.