East Africas onshore oil promise has now been a few years in the making

The first Ugandan oil discoveries were made in 2006, while in 2010-12 discoveries were also made in Kenya. Optimism was naturally very high with oil around US$100/barrel. However even today, IOCs seem keen to move forward – at least in theory.

The main obstacle for FIDs (Final Investment Decision) and development progress is export lines from what, in effect, for now, remain stranded assets. The difficulty in agreeing an export line has several layers. In Uganda, for a long time, there was disagreement between IOCs and the government, with the former preferring export of all the crude to a sea coast and the latter advocating that all or most of the crude would supply an integrated refining project, supplying refined products for the wider East and Central African region.

Ugandan hopes for a large export refinery have since abated, as realism about the limits of regional demand and costly logistics have set in. Plans have been gradually revised down to a possible small 30,000 bpd refinery, which would leave most crude available for export. Patient reluctance from IOCs to commit to developing the oilfields in western Uganda as long as the government pushed for an integrated refinery deal, clearly helped to bring realism into the government’s calculations on this point. IOCs were adamant that the economics of a regional export refinery, given the underdeveloped logistics and the weak regional market, were unattractive.

Finding an export route

Yet, finding an export route for the crude has proved tricky. The waxy Ugandan crude raises the technical requirements on the pipeline from the simplest technical options, which will be reflected in the project’s cost.

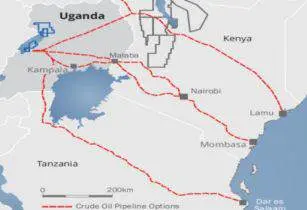

Agreeing on a route through Kenya and on Kenyan transit fees has also proved difficult. Political security has become an issue too. After having been regarded as one of Africa’s most stable economies for decades, the political situation in Kenya has changed for the worse over the past 10 years. Militant infiltration from Somalia is one issue, which in the past few years has coe to pose a significant security risk to one of the proposed pipeline routes – the one to Kenya’s northern port of Lamu.

Fundamentally worse is the political instability and internal violence which erupted in 2007-2008 following the contested presidential elections. Effects from that conflict continue to simmer and investors have not been entirely confident something similar could not happen again. Another reason for why the export pipeline project has not got off the ground is that Kenya is unclear whether to combine the Ugandan export project with its own need for a link to northwestern Kenya.

Initially, Uganda and Kenya had a preference for the Ugandan crude to move through a pipeline passing Nairobi and reaching the sea at the port of Mombasa, while Kenyan crude would run in a northern corridor to Lamu, which, from northwestern Kenya, could be extended to South Sudan - and in the case of discoveries – also to southern Ethiopia.

The latter project was launched as the LAPSSET (Lamu Port - South Sudan - Ethiopia Transport Corridor) scheme. However, Kenya only has so far proven-up 0.6mn barrels of reserves, including other volumes in order to make the project feasible from the onset.

The rest of this article can be found on page 16 of Oil Review Africahttps://www.oilreviewafrica.com/magazine/current-issue