An average capex of US$3bn per year would be spent on eight oil and gas fields in Mozambique between 2018 and 2020, according to GlobalData, a leading data and analytics company

The report further added that capital expenditure into Mozambique’s oil and gas projects will add up to US$9.1bn over the three-year period in the upstream capital expenditure by 2020.

Ultra-deepwater projects will be responsible for more than 65 per cent of US$9.1bn of upstream capital expenditure in Mozambique or US$6.2bn by 2020. The deepwater projects will account for 25 per cent of upstream capital expenditure with US$2.3bn by 2020, while onshore projects will necessitate US$600mn in capital expenditure over the period.

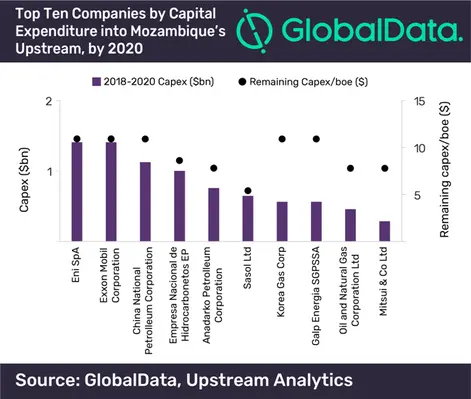

GlobalData expects that Eni SpA and Exxon Mobil Corporation will lead Mozambique in capital expenditure, each investing US$1.4bn into the country’s upstream projects by 2020. China National Petroleum Corporation (CNPC) will follow with US$1.1bn investment into Mozambique’s projects between 2018 and 2020.

Coral South Project, a planned ultra-deepwater conventional gas field, is set to lead capital investment with US$4.3bn to be spent between 2018 and 2020. Eni East Africa SpA is the operator for the field. Golfinho-Atum Complex, a deepwater conventional gas field in the Rovuma Basin, will follow next with a capex of US$2.3bn. Anadarko Mozambique Area 1, Limitada is its operator. Gas from both projects will be marketed as liquefied natural gas (LNG).

GlobalData reports the average remaining capital expenditure per barrel of oil equivalent (capex/boe) for Mozambique projects at US$6. Deepwater projects have the highest remaining capex/boe at US$6.8, followed by onshore and ultra-deepwater projects with US$5.9 and US$5.8 respectively.