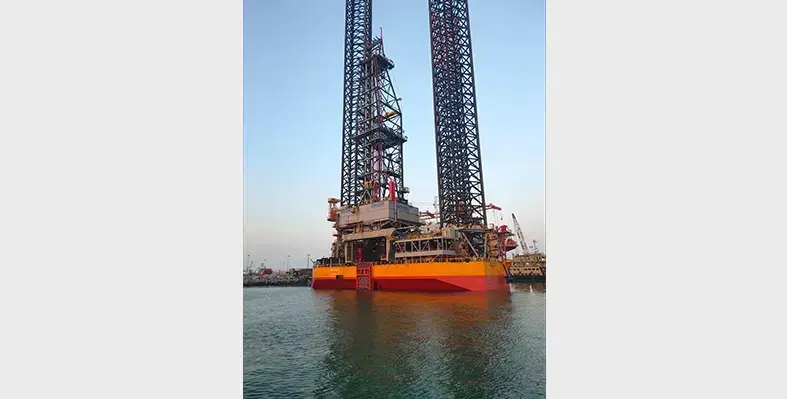

With an aim to boost Angola's national oil production, Etu Energias has initiated its redevelopment strategy at Block 2/05 in Soyo, Zaire Province, with the deployment of the SMS ESSA rig

The jack-up rig will initiate an intensive drilling campaign that includes the drilling of three development wells, one exploration well, and five workovers in existing wells.

Etu Energias is the operator of the block, in partnership with Poliedro, Kotoil, Falcon Oil and Prodoil. The campaign is aligned with the minimum work commitment agreed upon with Angolan authorities and is a key component of the broader strategy to increase production and unlock value from Block 2/05.

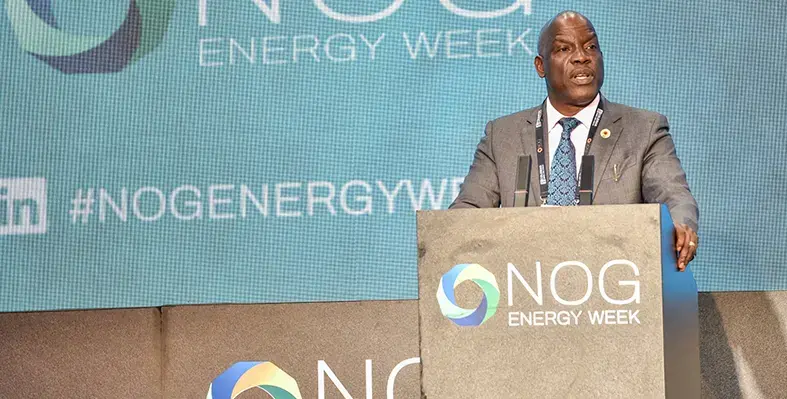

“The arrival and commissioning of the SMS rig represent a strategic investment in boosting Angola’s national crude oil production. This milestone reaffirms the growing technical and financial capacity of Etu Energias and its partners, and shows we are increasingly prepared to generate value and face the sector’s challenges with confidence,” said Edson R Dos Santos, chairman of the Board of Etu Energias.

The SMS ESSA rig was built at the COSCO Shipping Heavy Industry shipyards in 2020. A modern unit equipped to operate in water depths of up to 30 m, the rig boasts high-performance technical capabilities that ensure efficient and safe operations.