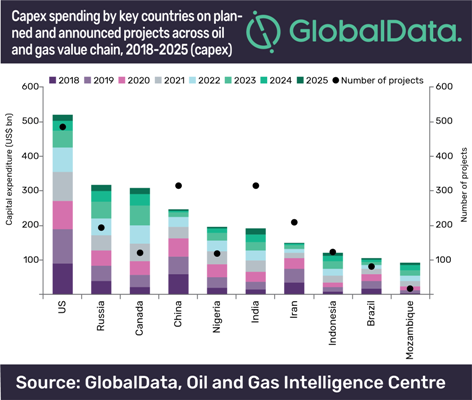

US is expected to spend US$521.4bn capital expenditure (capex) on 484 oil and gas projects by 2025, according to data and analytics company GlobalData

A total capital expenditure (capex) of US$3.6 trillion is expected to be spent globally across oil and gas value chain on planned and announced projects during 2018 to 2025, the company added.

The company’s report: ‘Q3 Global Oil and Gas Capital Expenditure Outlook – Gazprom Leads New-Build Capex Outlook Among Companies has revealed that, globally, the US, Russia, and Canada are the top countries to lead the new-build capex outlook.

Russia and Canada are expected to spent US$317.3bn (192 projects) and US$309.8bn (119 projects), respectively.

In the upstream sector, Russia is expected to lead among countries with capex of US$77.5bn to be spent on 54 planned and announced fields globally. Brazil and the US follow, each with almost the same capex of US$70bn.

GlobalData's report found that the US is expected to lead in the pipelines segment with capex of US$123.6bn to bring 165 planned and announced projects online by 2025.

In the gas processing segment, Russia is to spend US$40.8bn on 13 new projects, expected to come online during the outlook period. On the LNG liquefaction front, the US leads with estimated capex of US$216.4bn on 32 upcoming liquefaction terminals by 2025, while China leads in regasification capex, with US$18.1bn to be spent on 22 upcoming regasification terminals.

In the underground gas storage segment, Turkey leads with estimated capex of US$11.4bn to be spent on seven planned gas storage terminals by 2025, while for liquids storage terminals, the US leads with capex of US$9.3bn expected to be spent on 32 upcoming projects.

On the downstream side, India is expected to lead with estimated capex of US$89bn on the development of nine crude oil refineries globally by 2025. In the petrochemical sector, China is expected to lead with estimated capex of US$76bn to be spent on 215 upcoming petrochemical plants.