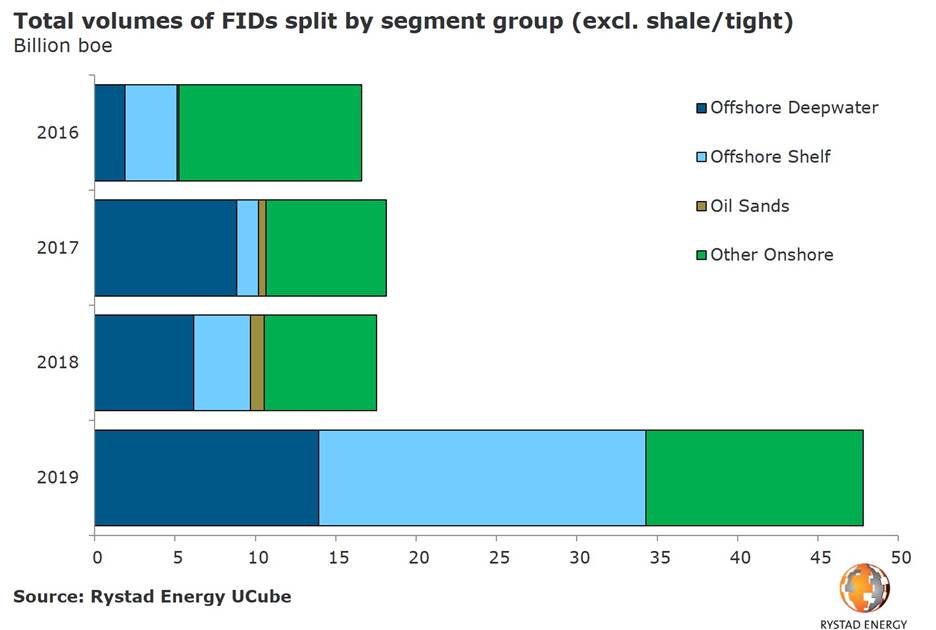

An increase in final investment decisions (FIDs) this year on new oil projects worldwide could see sanctioned volumes of oil and gas almost triple compared to last year’s tally, said business intelligence company Rystad Energy

Collective volumes could swell by more than 46bn boe, according to research conducted by Rystad Energy.

Readul Islam, an upstream research analyst of Rystad Energy, said, “We expect global FID volumes in 2019 to triple over last year, and 2019’s megaproject awards could lead to billions of subcontracting dollars in coming years.”

“The only supply segment likely to shrink this year is the oil sands, whereas deepwater, offshore shelf and other conventional onshore developments are all poised to show substantial growth. From a geographical perspective, all regions are headed for robust growth except Europe and North America, still bearing in mind that shale plays are not included in these numbers,” he added.

Research by Rystad Energy has found that three main factors drive growth”

-Greener fuels: As demand for cleaner fuels rises, the threat of under-supply of LNG in the mid-2020s is likely to spur sanctions on natural gas projects in Africa, Australia, the Middle East and Russia. This year, LNG projects will make up one-third of the estimated FID volumes.

-Project delays: Following the 2014 price crash, operators hit the drawing boards to try and make their projects fly at lower prices, resulting in project delays. These delayed projects can account for almost a quarter of FID volumes in 2019.

-Saudi Arabia: The kingdom appears to greenlight three major offshore shelf expansion projects, which would collectively account for almost a fifth of the global FID volumes this year.

The company has stated that there are downside risks to this forecast. “The FID harvest this year is incredibly high: delays in a few megaprojects currently expected to be approved in the second half of 2019 could significantly reduce the volume,” warned Islam.

The company has stated that there are downside risks to this forecast. “The FID harvest this year is incredibly high: delays in a few megaprojects currently expected to be approved in the second half of 2019 could significantly reduce the volume,” warned Islam.

Rystad Energy does not expect the 2019 FID surge to result in a proportionate increase in contracting opportunities for the oilfield service (OFS) sector. Considering areas of 25mn boe and above, which account for more than 97 per cent of the forecast volume, the 2019 FID count is less than 12 per cent higher than the number of individual projects approved in 2018.

The silver lining for many suppliers as they navigate an ultra-competitive landscape is that the huge projects approved in 2019 will generate contracts worth billions of dollars for facilities and services in the following years, the research concluded.