In The Spotlight

The AK-2H well in the Seme Field in Block 1, Benin, inches towards production as Akrake Petroleum Benin SA concluded drilling operations in the area

The company is now working on completion activities to make the well production-ready by early February. It has been designed to drain the western section of the Seme Field from the H6 reservoir.

The well will be screened covering the reservoir sandstone formation, and a down-hole electrical submersible pump (ESP) will be installed.

Alongside, installation of the mobile offshore production unit (MOPU), Stella Energy 1, and the floating storage & offloading unit (FSO), Kristina, are in the final stages.

The MOPU installation activities which involved flowlines connection set-ups and other technical addressing were responsible for some delays in production start-up.

Akrake Petroleum's Seme Field redevelopment campaign involves a 100-day three-well work-programme. It includes the drilling of two horizontal production wells in the H6 formation (previously developed), as well as a deeper vertical appraisal well to gather data from the H7 and H8 reservoirs, to facilitate the potential advancement to Phase 2 of the development.

As operator of a joint venture with the Nigerian National Petroleum Company Limited, Chevron Nigeria Limited has completed appraisal and exploration activities in the Awodi-07 well positioned in the shallow offshore western Niger Delta

Amid a 40%-60% dynamic with NNPC retaining the larger share and Chevron enjoying Operator status, both the partners are well positioned to expand their asset portfolios by leveraging resources, expertise and investment in developing Nigeria’s oil and gas resources. Through this collaboration, the partners aim to increase oil production to about 146,000 barrels per day.

With promising results reinforcing the prospectivity of the Awodi-07 well, this comes as a win for the partners as it significantly adds to their collective objective of boosting Nigeria's production rates to 146,000 barrels per day. Several reservoir zones in the well were underlined with considerable hydrocarbon presence. This was confirmed following months of consistent exploration efforts led by sound technical evaluation.

Drilling had commenced late last year in compliance with approved operational and regulatory standards, followed by comprehensive testing, logging, and data acquisition, before the well was safely secured.

Calling it a milestone led by sustained collaboration and stable working environment, Udy Ntia, executive vice president - upstream, NNPC, said, “This discovery underscores the importance of disciplined exploration programmes, strong partnerships, and the positive impact of the reforms introduced under the Petroleum Industry Act. We look forward to working closely with Chevron Nigeria Limited to mature this opportunity and progress it towards timely development and monetisation.”

On the same tune, NNPC's group chief executive officer, Bashir Bayo Ojulari, said, “The success of the Awodi-07 well further reinforces the strength of the NNPC Ltd/CNL Joint Venture and our shared commitment to responsibly growing Nigeria’s hydrocarbon reserves. This achievement aligns squarely with our strategic priorities of increasing production, enhancing national energy security, and delivering sustainable value for the Nigerian people.”

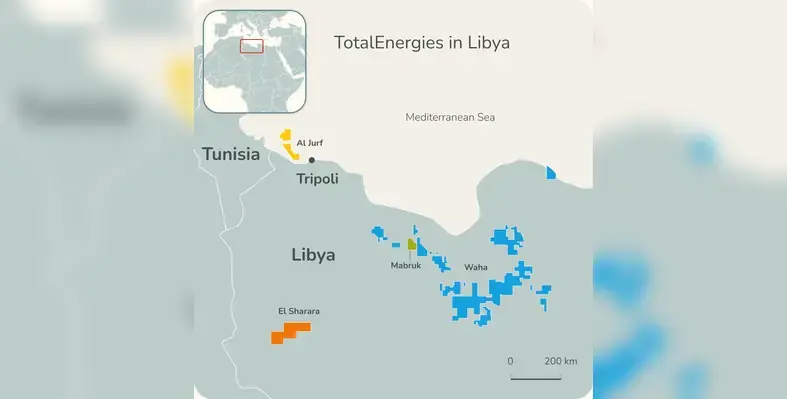

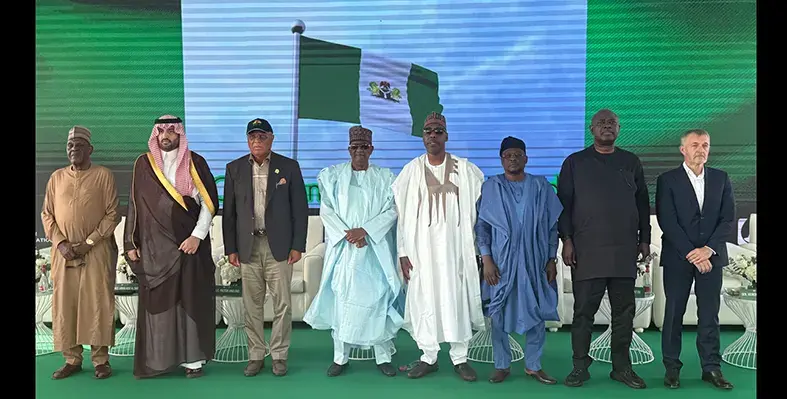

The Waha Concessions onshore Libya will see increased production as TotalEnergies secured a 34-year extension agreement during the recently-concluded Libya Energy & Economy Summit in Tripoli

Signed by the major's chairman and chief executive officer, Patrick Pouyanné, in the presence of Abdul Hamid Dbeiba, Prime Minister of the Government of National Unity, the agreement permits the company to operate in the region for as long as 31 December 2050. This move further solidifies TotalEnergies' presence in Libya that goes back as far as 1956.

“As we celebrate 70 years of presence in Libya, we are pleased to sign this agreement, and I would like to thank the Libyan authorities for their continued support, in particular Dr. Khalifa Rajab Abdulsadek, Minister of Oil and Gas of Libya and Masoud Suleman, Chairman of the National Oil Corporation (NOC)," said Pouyanné.

As the concessions continue to produce around 370,000 barrels of oil equivalent per day (boe/d), TotalEnergies plans to kickstart additional phased investments that will advance the development of the North Gialo field. This will unlock 100,000 boe/d of boosted production.

As the announcement marked the major's elaborate plans for long-term production strategy from the region, Pouyanné said, "Extending the Waha concession, with its low cost and low emission giant resources offering many opportunities to grow production, fits perfectly with our strategy.”

The Waha Concessions onshore Libya will see increased production as TotalEnergies secured a 34-year extension agreement during the recently-concluded Libya Energy & Economy Summit in Tripoli

Signed by the major's chairman and chief executive officer, Patrick Pouyanné, in the presence of Abdul Hamid Dbeiba, Prime Minister of the Government of National Unity, the agreement permits the company to operate in the region for as long as 31 December 2050. This move further solidifies TotalEnergies' presence in Libya that goes back as far as 1956.

“As we celebrate 70 years of presence in Libya, we are pleased to sign this agreement, and I would like to thank the Libyan authorities for their continued support, in particular Dr. Khalifa Rajab Abdulsadek, Minister of Oil and Gas of Libya and Masoud Suleman, Chairman of the National Oil Corporation (NOC)," said Pouyanné.

As the concessions continue to produce around 370,000 barrels of oil equivalent per day (boe/d), TotalEnergies plans to kickstart additional phased investments that will advance the development of the North Gialo field. This will unlock 100,000 boe/d of boosted production.

As the announcement marked the major's elaborate plans for long-term production strategy from the region, Pouyanné said, "Extending the Waha concession, with its low cost and low emission giant resources offering many opportunities to grow production, fits perfectly with our strategy.”

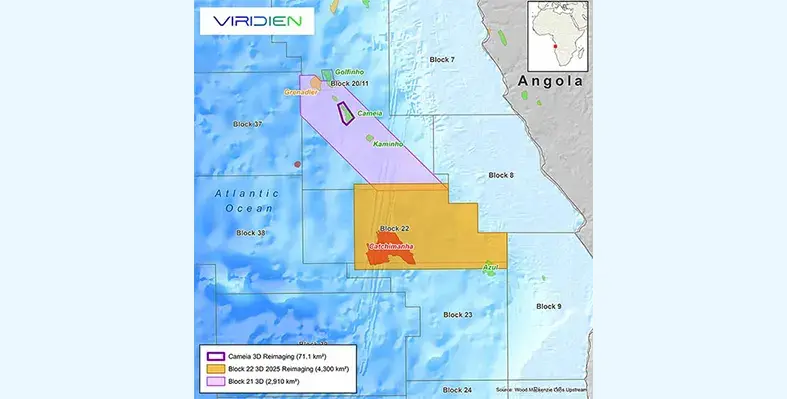

As Angola gears up for its upcoming licensing round, Viridien has announced a new multi-client seismic reimaging programme over Angola’s highly prospective offshore Block 22

The 4,300 sq km high-end data set will bring valuable insight into underexplored structures along the Atlantic Hinge zone, following the same trend as the proven Cameia and Golfinho fields. Fast-track results are scheduled for delivery in Q1 2026 and final products in Q3/Q4 2026.

The Block 22 data set will be reimaged by using Viridien's latest proven proprietary technologies, including time-lag FWI, Q-FWI, Q-Kirchhoff and advanced deghosting and demultiple. This data will complement its 2,900 sq km of data over nearby block 20/11, giving operators access to a combined regional coverage of over 7,200 sq km of ultramodern broadband PSDM data to conduct regional pre-salt and post-salt play evaluation in the Kwanza Basin.

Dechun Lin, Head of Earth Data, Viridien, said, “Viridien is delighted to continue its strong relationship with Angola's national energy agency, ANPG (Agência Nacional de Petróleo, Gás e Biocombustíveis), and longstanding presence in Angola by committing to this new reimaging project which will support their important upcoming licensing round. We have the most modern 3D broadband seismic data available offshore Angola and will continue to generate value from it to provide critical support for industry decision-making and help to increase exploration success.”

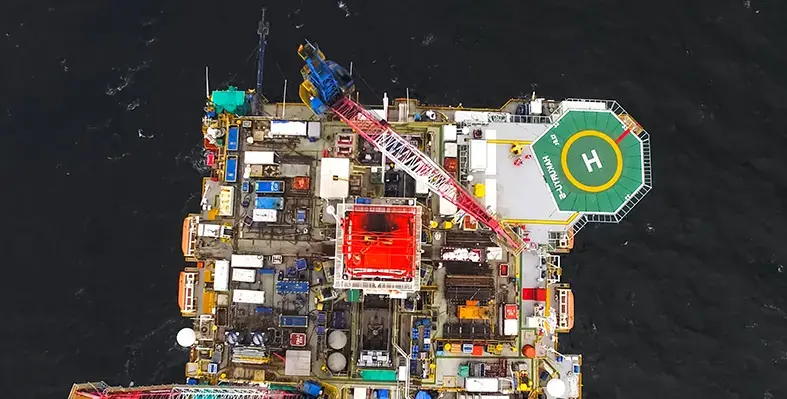

This development was marked during the sail away ceremony organised by the company. (Image source: Drydocks)

Production from Nigeria’s Okwok field is set to soar as the EMEM floating production storage and offloading (FPSO) vessel is ready for operation following full conversion and integration by Drydocks World

This development was marked during the sail away ceremony organised by the company. The comprehesive refurbishment and conversion work that took place at the company's Dubai facility is backed by its expertise as an integrated logistics and supply chain network across Africa and worldwide. The project involved major structural modifications, full marine system upgrades, and the installation and integration of 19 topside production and utility modules, transforming the former oil tanker into a fully operational offshore production unit.

Captain Rado Antolovic, CEO of Drydocks World, said, "Commissioned by World Carrier Corporation (WCC) on behalf of Oriental Energy Resources Limited (OERL), the EMEM FPSO will support production at the Okwok oil field in Nigeria’s offshore Petroleum Mining Lease 15.

"Once operational, the EMEM FPSO will be able to process up to 70,000 barrels of total liquids per day, manage roughly 15 million standard cubic feet of gas daily and store up to one million barrels of crude oil. Designed to operate continuously for up to 15 years without drydocking, the vessel is expected to begin production in Q1 2026."

The vessel was officially named in December 2024 during a ceremony at Drydocks World, attended by Nigeria’s Vice President, Senator Kashim Shettima, along with senior government, industry, and partner representatives. The event underlined the project’s strategic role in boosting Nigeria’s offshore production capabilities and broader industrial development.

With a portfolio of over 50 major vessel refurbishment and conversion projects, including more than 30 FPSO deliveries, Drydocks World continues to be a trusted provider of complex offshore engineering solutions. The successful completion of the EMEM FPSO project reinforces the company’s role in advancing offshore energy infrastructure across Nigeria and the wider African region.

Egyptian engineering procurement and construction contractor, Petrojet, which is particularly well established in Abu Dhabi, has signed a US$273mn contract to facilitate the construction of a 193 km natural gas pipeline in Oman

Further advancing the rapidly growing mutual cooperation on natural gas infrastructure, the deal was initiated at the presence of Karim Badawi, Egypt’s Minister of Petroleum and Mineral Resources, and Mansoor Ali Al Abdali, Managing Director of OQ Gas Networks (OQGN).

The contract also finalised the delivery of the first phase of OQGN’s hydrogen pipeline network, which will include 400 km of the planned 2,000 km system at approximately US$250mn.

This contract win will support the company in preparation for the upcoming green hydrogen and Natural Gas Liquids Extraction (NGLE) projects, leveraging its international expertise as Oman expands its new-energy ambitions.

The contract's relevance couldn't have been better timed as it was announced in line with Oman’s Green Hydrogen Summit, where collaboration opportunities were explored.

The summit also reviewed progress by Engineering for the Petroleum and Process Industries (ENPPI) and Egypt Gas as they complete registration on OQGN’s Tawreed platform. The Duqm Refinery is nearing completion as the companies finalise technical pre-qualification documents for gas pressure reduction stations.

ENPPI, which partners with OQGN, Oman Tank Terminal Company (OTTCO), and Duqm Refinery, remains a key contender for upcoming project tenders. Discussions also highlighted broader Egyptian company participation in Oman’s energy projects.

As the Uganda National Oil Company aims to build a crude refinery, it has reached out to a unit of global commodities trader, Vitol, for a US$2bn loan to support the project alongside construction and infrastructure developments

According to Henry Musasizi, Uganda's junior finance minister, this seven-year tenor loan from Vitol Bahrain EC (VBA) comes with an interest rate of 4.92%. The minister worked on advancing the approval process for the credit line and the loan, which involved significant lawmakers, who sanctioned the development with a majority verdict.

Musasizi said that Vitol's support "presents an opportunity to access non-traditional financing to implement. ..projects and support the government in developing national infrastructure."

Vitol Bahrain EC has a long-standing presence in Uganda's downstream sector, functioning as the sole supplier of refined petroleum products to UNOC, before the state-owned company sells it to retailers across the country.

Alongside the refinery, the loan amount will also be covering road construction, a petroleum products storage terminal and extension of a petroleum pipeline from western Kenya to Uganda's capital Kampala.

Previously, the UNOC also concluded a deal with the UAE-based Alpha MBM Investments, whereby a domestic refinery with a capacity of 60,000 barrels per day is in the pipeline. The agreement accords 60% stake on the refinery to the UAE firm while UNOC retains 40%.

Uganda is looking to begin commercial oil generation starting next year from fields in its west.

ADIPEC 2025 will take place in Abu Dhabi, UAE, from 3-6 November 2025, with an expanded conference and exhibition programme aimed at addressing the challenges facing the global energy sector

The event will focus on two critical imperatives: building resilience in the energy system and scaling transformative solutions to accelerate global progress.

The theme for ADIPEC 2025, "Energy. Intelligence. Impact.", underscores the need for secure energy to drive inclusive growth, the intelligence to navigate the complexities of today's energy landscape, and the impact that translates vision into tangible progress for markets, people, and the planet. Over the course of four days, the event will explore four key themes, from new energy technologies and geopolitics to digital transformation and building a resilient, future-ready energy system.

This year, the ADIPEC conferences have been streamlined into two comprehensive programmes: the Strategic Conference and the Technical Conference. The event will feature over 380 sessions, with more than 1,800 speakers, including ministers, CEOs, academics, industry experts, and youth leaders. The aim is to turn dialogue into action by showcasing solutions and catalysing collaborations that drive real, measurable impact across the energy sector. The platform will promote intelligent choices, focusing on leveraging all viable energy sources and technologies to build sustainable systems that can deliver energy to more people, at lower cost, and with reduced carbon emissions.

The ADIPEC 2025 Exhibition will span 17 halls and host more than 2,250 exhibitors from across the global energy ecosystem, including 54 National Oil Companies (NOCs), International Oil Companies (IOCs), National Energy Companies (NECs), and International Energy Companies (IECs). It will also feature 30 dedicated country pavilions and four specialised industry zones focused on decarbonisation, digitalisation, maritime and logistics, and artificial intelligence.

ADIPEC 2025 is expected to attract more than 205,000 attendees from around the world, creating unique opportunities for collaboration, innovation, and progress within the energy sector.